Matthew Caldwell admits that he had a bit to learn when, in April 2014, he went to South Florida to oversee the Florida Panthers and BB&T Center as chief operating officer of Sunrise Sports & Entertainment.

“I had not worked in sports before; never sold a ticket or a sponsorship, never had to run an arena, never had to consider the intricacies that go into food and beverage, or parking, or customer experience,” Caldwell said.

During the first few weeks, he wanted to help out his fellow staffers with season-ticket holder communications. “I’m showing up fielding those calls about their pricing and why something was wrong, and I wasn’t even familiar enough with the arena itself to even know.”

But in many ways, Caldwell, who was promoted to president and CEO in April of this year, typifies the approach that Vincent Viola and Douglas Cifu have taken with the team since they acquired it in September 2013 for $250 million: hire smart people, even if they are not traditionally trained in a particular area; encourage open communication; and pay precise attention to detail.

It’s an approach that has worked with the pair’s other business ventures and now is paying off for the Panthers, a team once mired in mediocrity but now turning heads on the ice and on the business front.

“Communication, camaraderie, trust, being very entrepreneurial — these are things that motivate you to come to work every day, and something that we all work hard on,” Caldwell said. “A person can be right out of college or have been in the business for 20 years; anyone can bring an idea to the forefront and we can execute on it — that’s something that makes people excited.”

‘The art of what we do’

While not raised far apart geographically — Cifu in Syosset on Long Island, Viola in Brooklyn — they followed different career paths. Cifu attended Columbia Law School and worked at law firm Paul, Weiss, where he was part of the firm’s management committee and focused largely on its private equity and mergers and acquisitions practices. Viola, who graduated from the U.S. Military Academy at West Point and served in the 101st Airborne Division, cut his teeth on the floor of the New York Mercantile Exchange before rising to be its chairman.

While serving as legal counsel on an M&A transaction, Cifu was introduced to Viola. They hit it off, leading to the two founding Virtu Financial in 2008, where Viola serves as the executive chairman and Cifu the CEO. Nasdaq now values the high-frequency trading and market-making firm at more than $2.2 billion.

Ultimately, Cifu explains, how he found himself in that position is similar to how Caldwell and many of the other

|

Douglas Cifu (left) and Vincent Viola have used their approach to other business ventures, including Virtu Financial, to rebuild the Panthers. Here, they celebrate Virtu’s IPO last year.

Photo by: AP Images |

Panthers staffers did as well.

“I’m a lawyer by background; not a market guy, not a trader, not a technologist — but now I’m the CEO of the largest electronic market-making firm in the world,” he said. “I got there because I worked hard, am a pretty smart guy, I put my nose to it and had a great teacher in Vinnie. With our firm, we’ve taken really smart young folks that haven’t been on Wall Street and taught them the art of what we do — we discussed if we took that same operating discipline and regiment into the sports world, might that be compelling?”

Cifu said he and Viola, both based in New York City but with houses in South Florida, agree on almost everything — “except for football. I’m a Giants fan; he’s a Jets fan.”

For the pair, a number of principles learned in their experiences in business apply to all their endeavors together. A dedication to finding smart people, even if they’re not traditionally trained in a particular area. A high level of transparency. Encouraging open communication at all levels. A culture of meritocracy, where all barriers to advancement are removed.

They also practice an extremely precise attention to detail, with a rigorous focus on risk management, perhaps stemming from Viola’s service in the military, which often had him jumping out of airplanes. To best showcase that, one might look at Virtu’s track record. The firm reported its daily win-loss ratio until 2014, and over a five-year span, it lost money only on a single day — an aberration made by a mistake in a trading model.

Caldwell, also a West Point graduate who served as a captain in the U.S. Army and worked in Goldman Sachs’ investment management division before joining Viola’s family office, said these mantras are “not just buzz words.”

The Panthers’ organizational chart reflects that approach. While Caldwell might have been new to sports and the issues of arena management, Executive Chairman Peter Luukko spent more than three decades in exactly that space, most recently as president of the Philadelphia Flyers and COO of Comcast Spectacor. Dale Tallon, president of hockey operations, spent 10 years playing in the NHL, 16 years as a radio and television analyst for the Chicago Blackhawks, and has spent much of the last 20 years in the front office, most notably as general manager for both Chicago and Florida. Assistant general manager Steve Werier was a corporate lawyer before he joined the front office.

NHL Commissioner Gary Bettman said that the first time he had a chance to speak with Viola was during an afternoon lunch meeting in 2013 after an introduction by then NBA Commissioner David Stern. Viola had been an alternate governor on the NBA Board of Governors, stemming from his minority ownership stake in the New Jersey Nets.

“Whether it’s his childhood, or his West Point education, or his time in the military, or his success in the financial community, he’s very focused and very diligent in what he does, and at the same time, he appreciates things and had a core value system that starts with integrity,” Bettman said. “The Panthers’ future is as bright as I can remember.”

Something they could fix

Luukko said he was sitting in a pair of sweatpants and a baseball cap in Westchester, Pa., when he received a call from Bettman that he should meet with Viola and Cifu. After deciding to leave Comcast Spectacor, Luukko had been planning to invest in new ventures and to spend more time with his two sons — both of whom play hockey in the Flyers organization. From afar, he wondered about South Florida as well.

“The team really had a bad run for a number of years; it wasn’t well-capitalized and was sort of chasing their tail,” Luukko said. “I remember when the team went to the Stanley Cup Finals and the arena was full, which led me to believe that with the right ownership, the right staff and the right group it could be viable, but because of the run of poor teams it was really hard to determine if the market was good or bad as it hadn’t been given a fair shot.”

|

Fans pack BB&T Center during the 2016 Stanley Cup playoffs.

Photo by: Getty Images |

Founded in 1993 by Wayne Huizenga, the team capitalized on early success, which led the Panthers to that aforementioned Stanley Cup Final appearance in 1996. But starting in 2000, the team fell into a tailspin of 10 straight years of missing the playoffs. Huizenga sold the team to a group of local businessmen led by Alan Cohen in 2001, who later stepped down in 2009 to let minority partners Cliff Viner and Stu Siegel operate the franchise.

Between 2000 and 2013, the team had a total of only 60 home sellouts.

As Cifu and Viola saw it, the high level of turnover across the team was at the core of its issues, and something they could fix.

“You look at the number of different ownership groups, general managers and coaches, how other than Pavel Bure that this team never had a consistent star and that for a few years you could put together an all-star team of former Panthers, you started to understand,” Cifu said. “People have choices with their entertainment dollars, particularly in South Florida, and we needed to make sure we would regain the trust of the community and honor our commitment.”

That commitment has come on and off the ice, albeit with some growing pains.

One of the team’s biggest complaints from season-ticket holders — and the reason many didn’t renew — was the sheer amount of giveaways and discounts. Previous ownership groups had flooded the market, hoping that boosting attendance, albeit artificially, would lead to long-term success. Instead, long-standing ticket holders were tired of sitting next to people who either paid much less than they did, or nothing in many cases, with very little other benefits.

“Vinnie and Doug ripped the Band-Aid off from day one,” said Caldwell, removing “the nonsense out of the

|

The team has thinned its sponsorship roster in favor of quality over quantity, and has provided partners more assets. They expect a higher spend in return.

Photo by: Getty Images |

market” by eliminating giveaways, adding season-ticket holder benefits and events, and adding a strict price integrity model that is fully available online. They also added 30 extra sales representatives to blanket the market with their new message.

The team took a similar approach to corporate sponsorships, where under the previous ownership a desire to draw revenue out of the market led to doing deals with virtually any company that would give the team a dollar, leading a marketer for higher-end brands to tell Caldwell that the arena’s hockey boards “looked like a flea market.”

Instead, the new message to sponsors was that the team would be limiting the number of sponsors to a much lower amount and would be providing more assets and a more communicative relationship, but would expect a much higher spend in return.

Given the drastic change, the market was quick to question the team early on.

“One thing we heard from both big corporate sponsors and season-ticket holders early on was that while they agree with what we were doing and wanted more value in their investment, we hadn’t won yet, and why not hold off on these changes until we were winning and in the playoffs,” Caldwell said.

“Our response was simple — we plan on being there, and this is how we’re structured and this is how we’re going to be going forward — we’re going to honor our commitment, and you can sit on the sidelines now, but watch what we do.”

By the numbers

So far, the results have been there. The season-ticket holder base has more than doubled since Viola and Cifu acquired the team, and Caldwell said they’re expecting to sell close to 10,000 season tickets for this coming season; they’ve had a 92 percent or better renewal rate the last two years. They’ve also added about $2.5 million of new sponsorship business this offseason. Ticketing, sponsorship and overall revenue has seen double-digit increases over the past year, Luukko said.

The commitment has extended on the ice as well. In the last year, the team has spent more than $180 million on re-signing its young players. Even after finishing with its highest point total in franchise history, the team believed it needed to make additional changes to achieve its goal of winning a Stanley Cup, spending more than $84 million to acquire new players, and trading prospects and draft picks to free up long-term cap space.

The Panthers also solidified their place in South Florida last year and shored up their finances by locking in a new

|

Viola faced questions early on, given the pace of changes at the team.

Photo by: Florida Panthers |

lease with Broward County for the BB&T Center, which provided $86 million in public funds for the team. The deal goes through 2028.

“I’ve always said it’s not the money that people invest in a team, it’s their emotions,” Luukko said. “They may have thought if you’re rumored to be leaving, why would I invest in them? If you’re constantly trading your best players, why would I invest? If you’re constantly losing your young players, why would I invest? Now we’ve told the marketplace we’re here to stay for a long time, and that’s right up there with winning.”

Cifu said he still views the team as in the early innings of a nine-inning game. “We’ve tried some things that failed, did some things that didn’t work really well, but I think we’ve come up with some good plans and ideas and we’re on our way,” he said.

In a radio interview in 2014, Cifu said the team was losing about $114,000 per day the previous season. An October 2015 report prepared by Stifel Nicolaus and Barrett Sports Group on behalf of Broward County estimated the team faced operating losses upward of $36 million in the 2014-15 season.

“Vinnie and I didn’t buy the team because we thought we’d get dividends and distributions,” said Cifu, who declined to specifically comment on the team’s revenue figures. “Obviously we would like the team to make money, and money to be flowing back to New York, which hasn’t happened yet, but if we can get to the point where we’re breaking even or even losing a responsible amount of money every year, we’d be fine with that.”

Said Cifu, “This is a far cry from some of the traditional hockey markets like Toronto or Montreal, but can we be Tampa or Nashville? Absolutely. Those are stable franchises that frankly generate significantly more revenue than we do. When we bought the team, Vinnie and I had a five-year plan that’s probably now more like a six- or seven-year plan, but we’ve had some success and we’re committed to it.”

For Caldwell, that success is coming — as long as the team continues to stick with the principles that helped lead Viola and Cifu to success in their other ventures.

“Committed is our big theme there — ownership is obviously committed, Broward County is completely committed, the players saw the commitment and they committed too,” he said.

Caldwell is committed as well, not only staying in close communication with both owners as they tend to their other businesses, but personally signing every single check that goes out the door on behalf of the team.

“It’s a very painful process and takes a lot of time,” he said with a laugh, noting that the practice was encouraged by Viola. “But when you recognize what your biggest spends are, where your biggest revenue streams are, what moves the needle and makes pennies go in and out, you take more ownership of it, and it makes me appreciate what we’re doing here so much more.”

Leading the Panthers

Vincent Viola

■ Owner, chairman and governor

■ Executive chairman at Virtu Financial; former chairman of the New York Mercantile Exchange

Doug Cifu

■ Vice chairman, partner and alternate governor

■ CEO at Virtu Financial; former partner at Paul, Weiss

Peter Luukko

■ Executive chairman

■ Former president and COO of Comcast Spectacor

Matthew Caldwell

■ President and CEO

■ Former vice president at Goldman Sachs; former U.S. military officer

Dale Tallon

■ President of hockey operations

■ Former general manager of the Panthers and Chicago Blackhawks

Tom Rowe

■ General manager

■ Former NHL player and AHL head coach

Source: Florida Panthers

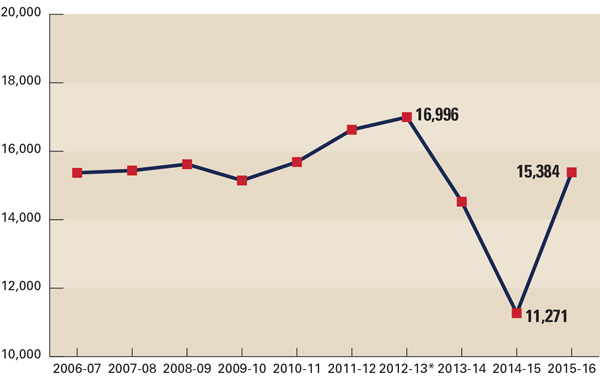

The Panthers averaged 3,700 viewers per game over the past decade

* 2012-13 season shortned by lockout

Source: SportsBusiness Journal research