|

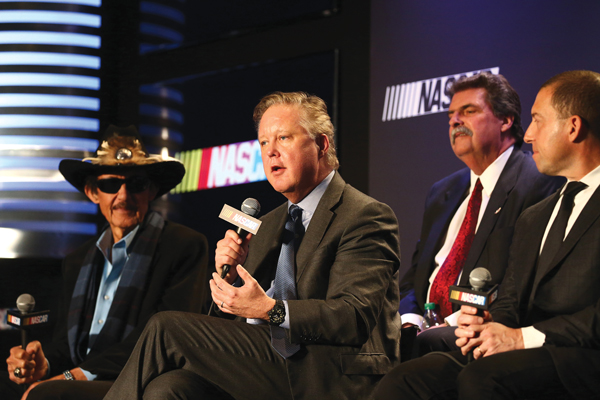

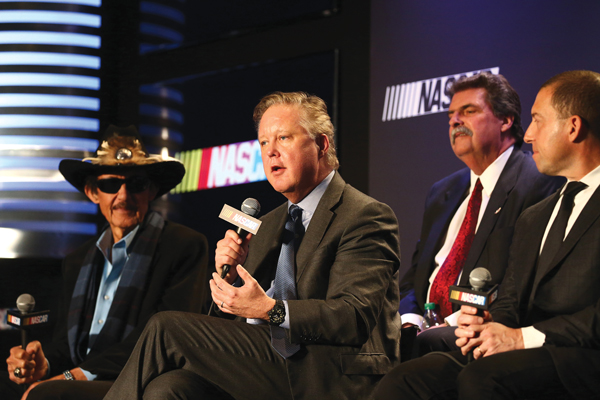

NASCAR Chairman and CEO Brian France outlines the new ownership structure.

Photo by: GETTY IMAGES

|

In the summer of 2014, when the Race Team Alliance’s chief representatives walked into their first meeting with NASCAR after announcing the group’s formation days earlier, they were greeted not by NASCAR’s top executives, but instead by the sanctioning body’s lawyers.

At the time, the implication from NASCAR was clear: Deal with our lawyers, because you’re not dealing with us.

Fast forward a year and a half to last week, when nine executives from both the sanctioning body and its teams strolled onto a stage in Charlotte to announce the sport’s new ownership structure, the opposite message was just as powerful.

As NASCAR launches its 2016 season this week, it does so having unified its stakeholders unlike any time in the sport’s long-fractured, 68-year history. The nine-year agreement with the teams provides for 36 charters, or franchises, among Sprint Cup Series teams across 40-car fields — which will be the basis of a system intended to increase new team investment and give outgoing team owners something of value as they leave.

In interviews last week with more than a dozen executives across the sport, the overwhelming consensus was that the system was the closest thing to a win-win that could have been expected, and was a minor miracle in that it happened without upsetting NASCAR’s apple cart, particularly after the inauspicious start with the RTA.

“A lot of it is a credit to Brian’s open-mindedness,” Rob Kauffman, chairman of the RTA, said of Brian France, NASCAR’s chairman and CEO. “We spoke very early on and he said, ‘Look, if we can come up with a way to improve this business model for teams and also the other stakeholders,’ he was more than open to trying to help figure it out.”

So how did the two sides get there?

The first step was getting all the teams on the same page philosophically, according to Steve Newmark, president of Roush Fenway Racing, who was one of the chief architects of the deal.

“From my perspective, the key first step in the process was the unification of the team owners around the concept of pursuing a long-term enterprise strategy,” Newmark wrote in an e-mail. “Although we continued to try to beat each other on the track every week, there was a strong sense of collaboration and cohesiveness among the teams that set the stage for productive negotiations with NASCAR.”

As in any negotiation, both sides had to compromise to reach the desired goal, sources familiar with the talks said. For example, a source said that the RTA pushed for teams to no longer be charged for certain administrative costs like credentials — which collectively cost teams around $8 million annually — but didn’t get that provision in the end. On the other hand, NASCAR, which traditionally has held a near iron-grip on all competition-related decisions, gave up some of its autonomy in order to grant teams a greater say in the sport’s governance.

The teams’ gain in governance is a not-to-be-discounted aspect that some executives think has been underplayed in the mainstream media.

Other factors in getting the teams and NASCAR on the same page, according to sources, was convincing the governing body that the RTA was looking more to improve the current ownership model than trying to change the allocation of the sport’s television money. Currently, racetracks collect 65 percent of TV revenue, teams get 25 percent and NASCAR takes 10 percent — percentages that will stay the same moving forward.

Another important factor was, for the most part, keeping the negotiations out of the press.

In terms of financials, in 2016 the total payment pool to teams from points events will be just under $228 million, according to sources, which is a slight increase from last year. That includes approximately $77 million in race purses; $57 million to chartered teams; $3 million to nonchartered teams; $68 million in payments to chartered teams for historical importance to the sport; and $23 million in the year-end points fund.

The vast disparity between what the chartered and nonchartered teams get is meant to provide an incentive to new owners in the sport to come in by buying a charter.

“The reality is there wasn’t a huge shift economically from NASCAR’s pockets to the team owners’ pockets,” said Andrew Kline, founder and managing director of investment bank Park Lane, which works with NASCAR and International Speedway Corp. on other projects. “But the big win for the owners is … now when you’re going to sell your team, you’re selling something of value to [new owners], so you’re actually creating enterprise value.

“That’s a big win for the owners, and it doesn’t hurt NASCAR at all to have owners who now have a more secure financial position.”

Brent Dewar, NASCAR’s chief operating officer, who was widely hailed by industry executives for his efforts to strike the charter deal, agreed and pointed to the guaranteed starting spots that chartered teams get as an example of the deal’s benefits.

“That’s when you get to a win-win-win — when we have more common-aligned interests,” Dewar said. “Even though we had to ratify the agreement, a few of the small teams were seeing benefits [even before the deal was done] because they could start planning their cycles if it was ratified, and just with their sponsors knowing they were going to be in the show was no insignificant event for a smaller team.”

Still, despite the step forward, there remains work to be done to continue improving the sport’s business model, some executives said, and not everyone is happy with the deal. For example, a team source noted that since profits are what ultimately drive value, the costs that it takes to run a team still need to be lessened for the charters to accrue true value.

But in the end, almost everyone agrees that the deal is a positive step for the sport.

“It’s incredibly impressive that NASCAR and the teams were able to pull together in such a significant way; it has been talked about for a long time, but largely talked about in a way it couldn’t be done,” said Marcus Smith, CEO of Speedway Motorsports Inc., which owns eight speedways that host NASCAR events. “To actually come to a conclusion with an agreement that everybody is on board with is really impressive.

“I think it’s great for the longevity of our sport, and something that will just strengthen the foundation for team ownership as we go forward.”