Verizon is close to completing an NBA content-rights deal.

Sources familiar with the pending deal said last week that the agreement would include intellectual property and other traditional sponsorship rights but is centered on content — which Verizon wants for over-the-top programming efforts, especially its recently launched go90 product. As a mobile-first service, go90 is aimed at the growing audience of millennial cord-cutters.

|

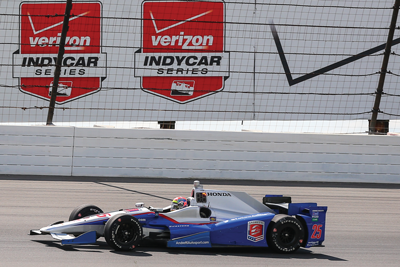

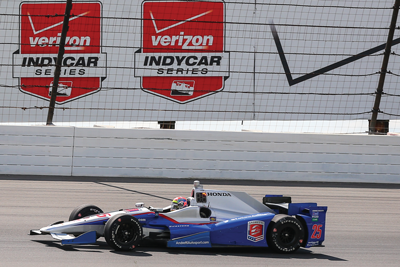

Verizon already has a title deal with the IndyCar Series and another big deal with the NFL.

Photo by: AP IMAGES

|

However, a Verizon-NBA deal would almost certainly not include live NBA games. Those rights are owned by ESPN/ABC and Turner under terms of nine-year deals valued at $24 billion that take effect next season. That means it will likely be shoulder

programming and lifestyle programming that would be part of the Verizon-NBA content, and possibly games from the other basketball inventory controlled by the NBA: the WNBA, the D-League and USA

Basketball.

While the deal had not been completed as of last week, NBA owners were briefed on the discussions at the NBA board of governors meeting in New York late last month. A source close to the negotiations said the deal was not finished before last week’s start of the NBA season because “the NBA wanted to sell a sponsorship and Verizon wanted content rights.”

At the board of governors meeting, owners were told that the deal will be a content-rich agreement. Financial terms of the pending deal could not be learned.

League officials declined to comment.

Even if no live games are involved in the deal, how longtime NBA digital and TV rights holder Turner will feel about the league adding another content partner remains to be seen. Nonetheless, the forthcoming deal is a harbinger of what’s ahead in terms of hybrid agreements, as wireless service providers morph into content providers. The most striking example is AT&T’s acquisition of satellite TV provider DirecTV, with its exclusive NFL Sunday Ticket package. Many industry observers similarly expect Dish Network to be acquired soon, with Verizon among the likely suspects for the buy side.

“The category has become a content arms race between AT&T and Verizon,” said former MLB and NFL sponsorship executive John Brody, now an independent consultant. “If I’m Verizon, I’m trying to scoop up every piece of content rights possible because I don’t know what I’ll be competing against when it comes to the new AT&T-DirecTV combination.”

Verizon is not foreign to the NBA. The company has had team-level deals with Phoenix, Portland, Sacramento and the Los Angeles Lakers, according to Resource Guide Live. It also holds naming rights to the home of the Washington Wizards, though that deal for Verizon Center expires at the end of 2018.

At the NBA, Verizon will replace Sprint, which did not renew its four-year $222 million deal signed in 2011 that at the time was the largest sponsorship in NBA history. With huge sponsorship-content commitments to the NFL (a deal valued at $1 billion over four years, through 2017) and a title deal with the IndyCar Series (10 years, $100 million, beginning last year), it was thought Verizon would be cutting back on other sponsorship properties. Last year, for example, it ended an eight-year sponsorship rights relationship with the NHL.

That it would still pay NBA pricing indicates how important content has become for Verizon, which has a multibillion-dollar ad budget, long one of the country’s biggest.

“With the notable exception being DirecTV and the NFL, I still don’t see customers making decisions based on content,” said Tim McGhee, the former AT&T executive director of sponsorships who now heads consultancy MSP Sports. “But that’s where they [wireless carriers] are heading. They’re becoming content companies, and it’s not going to matter what platform they deliver content to as much as the content itself.”