|

Photo by: GETTY IMAGES

|

With its record reach of 4.4 million U.S. households, the Mayweather-Pacquiao fight gave sponsors of the fight unprecedented exposure. Here's an analysis of the sponsor value of that in-home exposure based on screen time and mentions during the telecast, provided by Kantar Media. Values are based on households, not viewers.

| Element |

Sponsor value |

Top sponsor |

Value |

| Ropes |

$6.8M |

Mayweather Promotions |

$1.9M |

| Canvas |

$5.8M |

Smart |

$2.3M |

| Mentions |

$5.4M |

MGM Grand |

$1.2M |

| Clock |

$4.8M |

Southpaw |

$1.8M |

| Team gear |

$3.9M |

Nike |

$1.4M |

| Trunks |

$3.4M |

Nike |

$1M |

| Seat |

$3.3M |

MLife |

$2.8M |

| Corner |

$2.9M |

Tecate |

$1.5M |

| LED boards |

$2.2M |

Southpaw |

$520,842 |

| Upper sign |

$1.6M |

Coca-Cola |

$1M |

| Total sponsor value: $45,433,674 |

Source: Kantar Media

A megafight that captured sports fans’ interest and a steady stream of shows on the networks they regularly watch are producing mounting evidence that boxing, counted out decades ago by most advertisers, may yet have life left in what were thought to be aging legs.

Scanning viewer data from the Floyd Mayweather vs. Manny Pacquiao pay-per-view, Todd DuBoef, the president of boxing promoter Top Rank, was struck more by the makeup of those who had returned to the sport than those who have stuck with it.

It came as no surprise that 2.9 million of the 4.4 million households that made the purchase were doing so for the first time in at least two years, as audience measurement firm Rentrak found. The only way to get from the previous record of 2.4 million to 4.4 million was to engage a new, or long dormant, audience.

DuBoef knew the fight had done that. He didn’t know whether, or how, they differed from boxing’s existing audience.

“You give your core fans the fight that they’ve been waiting years for and you figure they’re all going to spend the $100 for it,” DuBoef said. “That’s great. But what really excites me is that there were about 2.9 million homes with people who we would not have counted as avid fans, and we got each of them to spend $100. That makes me very bullish.

“I think we went general market. And that proves general market appeal.”

For years, those selling boxing to networks and advertisers have positioned the sport’s story this way: An avid base of about 1.5 million fans, most of them dedicated enough to pay for premium channels HBO and Showtime to purchase the two or three biggest fights of the year on pay-per-view.

Only 35 percent of the 4.4 million households that bought the record-smashing Floyd Mayweather vs. Manny Pacquiao pay-per-view had purchased a PPV featuring either fighter in the last two years, a span that offered four chances to watch Mayweather and three to watch Pacquiao. A look at the audience, based on set-top-box data from about 15 million households in all 210 U.S. DMAs, collected by audience measurement company Rentrak. To read: An index of 100 indicates average. A 110 would be 10 percent more likely to fit into a category; a 46 would be 54 percent less likely.

| Less than $50,000 |

35.7% |

| More than $75,000 |

39.7% |

| More than $100,000 |

21.4% |

| Hispanic* |

452 |

| Black, non-Hispanic |

110 |

| White, non-Hispanic |

42 |

| Asian and other |

46 |

| Less than $50,000 |

31.7% |

| More than $75,000 |

45.4% |

| More than $100,000 |

25.7% |

| Hispanic |

399 |

| Black, non-Hispanic |

62 |

| White, non-Hispanic |

51 |

| Asian and other |

146 |

| Less than $50,000 |

26.5% |

| More than $75,000 |

53% |

| More than $100,000 |

32.3% |

| Hispanic |

199 |

| Black, non-Hispanic |

112 |

| White, non-Hispanic |

82 |

| Asian and other |

90 |

* Mayweather's last six fights had been against Hispanic opponents.

Source: Rentrak

Through the last decade, boxing’s sponsor base has grown, but it largely has been driven by the desire of brands to reach Hispanics. Mexican beer brands Tecate and Corona dominate the sport. Other brands that have played regularly typically have funded those programs from their Hispanic marketing budgets.

An analysis of viewer data collected from set-top cable and satellite boxes by audience measurement company Rentrak indicated that, while those who bought other Mayweather and Pacquiao fights in the last two years skewed heavily Hispanic, those who were either new or returning to boxing looked more like the audience for other sports with regard to race, ethnicity, age and income (see chart).

They still were almost twice as likely to be Hispanic as the average TV household. But that was down considerably from the previous buyers of Mayweather, who were 4 1/2 times more likely to be Hispanic, or of Pacquiao, who were almost four times as likely to be Hispanic. New viewers were about 10 percent more likely to be African-American and 18 percent less likely to be white, non-Hispanic.

About two-thirds of new viewers fit into the 25-54 age demographic, a higher rate than for those who previously bought either Mayweather or Pacquiao pay-per-views. Almost one-third were 18-34. Slightly more than half made more than the household average of $75,000 a year and almost one-third made upward of $100,000 a year, giving them a higher income level than previous buyers.

The data showed that the megafight remained the strong Hispanic play that previous pay-per-views have been, but it also crossed over, as fight promoters hoped it would.

“This fight drew in a very different fan base than what normally these two guys, who are the two biggest personalities in the sport by far, typically are able to draw,” said David Algranati, Rentrak senior vice president, who oversees custom research for the company. “I think it speaks to the potential for the sport if it’s marketed well. I don’t know how to look at this and come up with a formula to replicate it. … But it’s at least a proof of concept that there’s a path to a really large group.”

Of course, the most lucrative fight in history is not necessarily an indicator of a broadened appeal for boxing any more than a boffo audience for the Kentucky Derby or Belmont is necessarily an indication of a resurgence in horse racing.

|

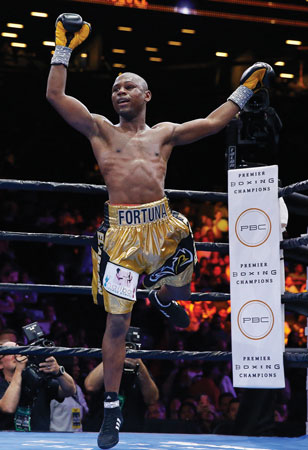

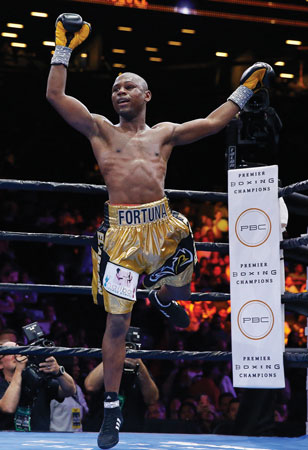

Javier Fortuna celebrates his victory during a May 29 PBC telecast on Spike.

Photo by: GETTY IMAGES

|

But the audience numbers posted in the first three months by Premier Boxing Champions may be. For the first time in two decades, a caliber of fight that has become the province of premium cable is back on broadly distributed networks NBC and CBS, as well as ESPN and Spike. Thus far, the ratings have been solid. Viewer demo information provided by Rentrak indicates an audience similar to those who sampled the pay-per-view (see chart below).

Viewership skews older than average, but not by a lot. The audience for most shows has been 5 to 10 percent less likely to be 25-54 than the average TV viewer. Other than for the shows on young-skewing Spike, household income levels have been solid: Only slightly more likely to be in the $50,000-$75,000 range and slightly less likely to be between $75,000 to $100,000.

Numbers for the fights on NBC and CBS have ranged from 1.4 million households to 3.3 million, according to Rentrak. Household numbers on Spike have been lower, but the network attributes that to its viewers’ propensity to watch combat sports in larger groups, a factor taken into account by Nielsen in its ratings, which show an average audience of 737,000 for the PBC on Spike.

If those numbers hold up, they should make the PBC a viable consideration for the sort of brands found in other sports, said Simon Wardle, chief strategy officer at sports marketing agency Octagon.

“It stacks up very well with most other properties,” Wardle said, pointing to the income levels reported by Rentrak. “It may well be a consequence of the fact that the primary source for boxing has been the premium channels. For years, the people who have had access to boxing have been the affluent households.”

While the PBC has delivered unprecedented heft, it’s not the only boxing property to return to more broadly distributed TV. Working with HBO, Top Rank in May launched “Friday Night Knockout,” a show that will air eight times this year on truTV.

On its May 15 broadcast, Top Rank went head-to-head against ESPN’s “Friday Night Fights.” ESPN had the slightly larger overall audience, but truTV had almost twice as many viewers age 18-49: 124,000 to 69,000, DuBoef said. TruTV also won the 18-34 demographic. “FNF” delivered the audience long associated with boxing in recent years, attracting 194,000 viewers over age 55.

Both audiences were small. But DuBoef saw the truTV show as evidence that he could break out of the traditional narrative of boxing: A sport largely for Hispanics and older men.

“Results get you beyond that perception,” DuBoef said. “Two weeks into the series Turner brings MetroPCS in, signed up to be the anchor. Sony PlayStation comes in right after them. Those are nontraditional sponsors for boxing. Those are good signs.”

Executives from the PBC and agencies representing them declined interview requests for this story, citing ongoing negotiations with sponsor prospects. But during an interview before the series launched in March, PBC Chief Operating Officer Ryan Caldwell alluded to the shift that might come as the series brought its heft to broadly distributed cable.

“There’s an impression discussion that has to be had across boxing now,” Caldwell said. “Do you try to do one big fight [Mayweather-Pacquiao] or do you try to go for monstrous continuous impressions. We don’t know how that plays out. But that’s an argument that has never been had in boxing.

“We don’t expect that every rating we put up across 40-plus dates is going to be amazing. But we do expect that having consistency and frequency starts to build real brand value for the advertisers and sponsors we want to talk to. They know we’re going to show up. They know we’re going to be on major network television and they will know the number of units and impressions that they can expect — which is revolutionarily different from what they’re used to from boxing.”

The launch of Premier Boxing Champions, a well-funded series with shows airing across a range of broadly distributed networks, has put boxing back in front of viewers at levels not seen in more than a decade. A look at the houshold audience for the series' first seven events, based on set-top-box data from Rentrak. To read: An index of 100 indicates average. A 102 would be 2 percent more likely to fit into a category; a 97 would be 3 percent less likely.

| Feature fight |

Network |

Date |

Households |

Ages 18-49 |

Age 25-54 |

$50,000 - $74,999 |

$75,000 - $99,999 |

$100,000 - $124,999 |

$125,000+ |

| Keith Thurman vs. Robert Guerrero |

NBC |

March 7 |

3.28M |

93 |

94 |

101 |

101 |

99 |

94 |

| Andre Berto vs. Josesito Lopez |

Spike |

March 13 |

539,000 |

99 |

98 |

99 |

92 |

82 |

53 |

| Adonis Stevenson vs. Sakio Bika |

CBS |

April 4 |

1.51M |

88 |

90 |

103 |

97 |

95 |

85 |

| Danny Garcia vs. Lamont Peterson |

NBC |

April 11 |

2.66M |

93 |

94 |

102 |

99 |

98 |

90 |

| Andre Dirrell vs. Badou Jack |

Spike |

April 24 |

326,000 |

101 |

100 |

102 |

92 |

78 |

57 |

| Omar Figueroa vs. Ricky Burns |

CBS |

May 9 |

1.49M |

91 |

92 |

101 |

95 |

95 |

77 |

| Andre Dirrell vs. James DeGale |

NBC |

May 23 |

1.41M |

91 |

93 |

91 |

93 |

98 |

106 |

Note: Metrics for the Amir Khan-Chris Algieri main event televised by Spike on May 29 were not available at press time. The Robert Guerrero-Aron Martinez main event scheduled for June 6 on NBC had not been contested as of press time.

Source: Rentrak