When Michael Waltrip Racing hosted 5-Hour Energy founder Manoj Bhargava and the company’s top distributors at the Daytona 500 last month, the hospitality effort carried extra significance.

5-Hour Energy, which sponsors Clint Bowyer in 24 races, is up for renewal this year, and MWR, which lost one full-season sponsor last year, wants to secure a commitment from the company to sponsor Bowyer in 2015.

5-Hour, which brought 50 guests to Daytona, “had a tremendous experience and despite the rain delay, they’re very interested in moving forward with us,” said Ty Norris, MWR’s executive vice president of business development.

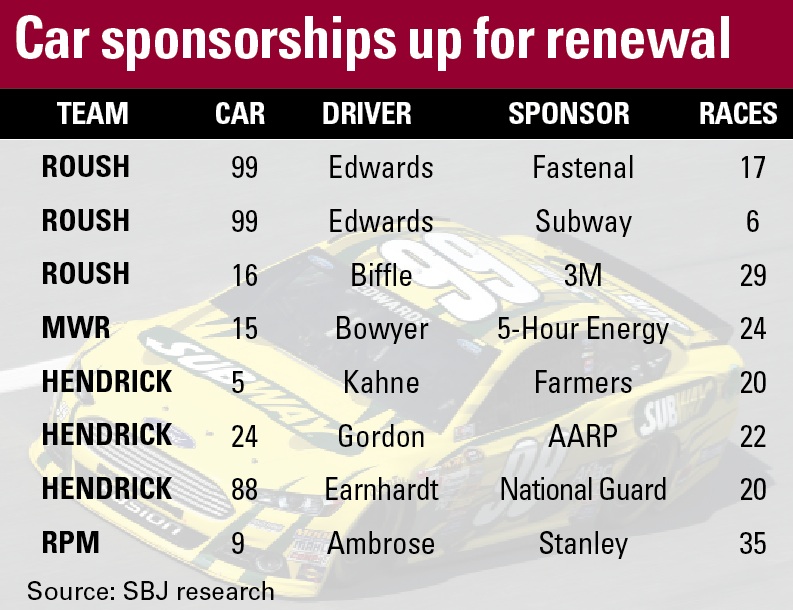

MWR is one of four major NASCAR teams that began 2014 needing to renew significant sponsorships. Eight deals across seven cars are up in the sport this year, making it the most major renewals to be up since 2011.

Most teams began negotiations early this year and hope to conclude them before the Sprint All-Star Race in May.

Team, sponsorship and marketing executives say the market has stabilized considerably since a comparable number of renewals were up for negotiation three years ago. Prices of NASCAR sponsorships have leveled off and the departure of sponsors from the sport has all but stopped.

“If anything, we’re in a better position on renewals than a few years ago,” said Pat Perkins, vice president of marketing at Hendrick Motorsports, which is working on renewals with Farmers, AARP and the National Guard. “The changes that NASCAR has made on the competitive and product front have been good and exciting. That energy is coming.”

But that doesn’t mean negotiations will be easy. Team executives say that while pricing has stabilized and corporate interest in NASCAR has rebounded, pressure is high for them to provide sponsors with new assets and value.

Over the last three years, MWR, Hendrick and Roush Fenway Racing, which has three major sponsorships up for renewal, have all added or enhanced their in-house digital capabilities, improved their hospitality and found ways to bring their partners together for business-to-business opportunities. For example, Roush Fenway this year did a deal with Walgreens for a series of promotional digital videos that feature its sponsor 3M, which is up for renewal.

Todd Stonis, an executive at Colorado-based sports marketing company Sports Dimensions, which consults on Shell’s motorsports business, said that ideas like the one Roush put forward are key to keeping partners interested in extending their partnership.

“The challenge across the board is to keep it fresh,” Stonis said. “When you’re with the same sponsor and same driver for multiple years, how do you continue to extract value in innovative ways to get the agencies to leverage the asset? Everyone is still very conscious about the bottom line and how they’re spending money.”

Sponsor executives echoed Stonis’ sentiment. One executive, who spoke on the condition of anonymity because the company is in renewal negotiations with a team, said the cost of NASCAR team sponsorships remains a challenge. Elite teams charge more than $400,000 a race.

“NASCAR is an expensive sport and everything is a la carte,” the executive said. “We’re looking at what we’ve gotten in the past and what potentially is different. Then it’s the added-value pieces and a lot of things that aren’t in the contract. How easy is a team to work with when you have a request?”

Nationwide chief marketer Matt Jauchius said that while those things are important, the key question comes earlier. “A sponsor has to ask: Are they and their customers attracted to the strategic platform NASCAR brings?” said Jauchius, whose company is in renewal talks with Roush Fenway Racing for a seven-race deal. “If they are, then investing in all the assets from TV to digital to tracks clearly pays off.”

TV is the one area that sponsors will be paying attention to and asking about during negotiations. Beginning in 2015, NASCAR will have seven of its Sprint Cup races shift from Fox to Fox Sports 1, which is in 20 million fewer homes, and 13 races will shift from ESPN to NBC Sports Network, which is in 20 million fewer homes than ESPN.

Teams are emphasizing that the networks will put more promotional emphasis on the sport than it received previously because they want to build those two sports networks. MWR even brought Fox and NBC executives to its sponsor summit for this season so they could tell sponsors what their plans are for coverage in 2015.

Jauchius doesn’t think NASCAR teams should worry too much about TV viewership even with the changes next year.

“We think the viewership at the Sprint Cup level is strong,” Jauchius said. “It might be down a couple points … but since the recession, all sports have suffered a slight decline.”

For now, teams remain encouraged about their renewal prospects. Only UPS has announced plans to discontinue its sponsorship. It sponsors one race at Roush Fenway Racing.

“The business environment has been good,” Perkins said. “There’s a lot of energy there. It’s just a matter of maintaining it and growing it.”