NASCAR is asking $12 million to $15 million a year for title sponsorship of its secondary series, which has been held by Nationwide Insurance since 2008.

NASCAR’s asking price is a minimum 20 percent increase above the $10 million in rights fees that Nationwide now pays. The insurer is dropping the title sponsorship after the 2014 season.

In addition to the rights fee, NASCAR executives are telling potential buyers they want a 10-year deal that includes a media commitment of more than $10 million and an activation commitment of more than $10 million, putting the overall annual spend at more than $30 million a year.

NASCAR officials declined to comment on pricing.

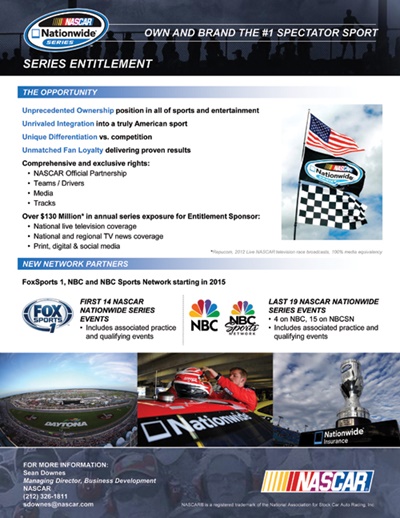

NASCAR sales materials obtained by SportsBusiness Journal say the sponsorship offers an “unprecedented ownership position in all of sports and entertainment” and “unmatched fan loyalty delivering proven results.” It says the series delivers $130 million in annual media exposure, according to Repucom.

It also touts the opportunity to work with two new broadcasters, Fox Sports and NBC, which scooped up ESPN’s rights to NASCAR earlier this year. Beginning in 2015, the series will be split, with 14 races on Fox Sports 1, four races on NBC; and 14 races on NBC Sports Network, which is in 20 million fewer homes than ESPN.

NASCAR plans to approach some of the brands that looked at the title sponsorship of the Nationwide Series when it was last available in 2007. Dunkin’ Donuts, AutoZone, KFC and Subway all analyzed the opportunity. Subway was close to finalizing a deal but changed its mind after negotiations began. Brands in the technology, consumer packaged goods and retail categories are other obvious targets.

In addition to working with two new network partners, a new sponsor also would bear much of the cost of rebranding the series.

“Whatever this thing is worth, it’s worth more in year three than year one, because of the name change, and I am sure that’s not the way NASCAR is looking at it,” said the CMO of a sports-centric brand that has a NASCAR team sponsorship in its portfolio.

NASCAR Chief Sales Officer Jim O’Connell is spearheading the sales effort. He sold the Nationwide deal in 2007, Camping World’s title sponsorship of the truck series in 2008, and Sprint’s recent renewal for the top series through 2016. He and his sales team will work with its 2015 broadcast partners, Fox and NBC, on the sales effort.

Viewership for the Nationwide Series is down slightly this year. Through 31 events, it was averaging 1.7 million viewers per event, a 14 percent decrease from 2012. The decline has been driven in part by the departure of Danica Patrick, who raced in the Nationwide Series last year before switching to the Sprint Cup Series full time this season.

In addition to viewership trends, potential sponsors will have to consider that NASCAR has changed competition rules for the series. Sprint Cup Series drivers can no longer win the secondary series championship, and fewer Cup drivers are racing in the series as a result. The change has turned the Nationwide Series into a proving ground for up-and-coming drivers who are less recognizable to casual NASCAR fans.

Nationwide, which has a NASCAR official sponsorship through 2017, latched onto that change and promoted many of those young drivers, like two-time series champion Ricky Stenhouse Jr., who moved from the Nationwide Series to the Sprint Cup Series this year. More recently, the insurer decided that it wanted to make the same transition, discontinuing its title sponsorship of the secondary series and following Stenhouse to the top Sprint Cup circuit.