Perhaps the most intriguing thing about compiling a list of disruptive European sports technology companies was how difficult it was to find them. At a time when digital is changing everything, why does sports seem to lag? There are two suggestions, one from each side of the negotiating table.

The sport sector is famously conservative, distrustful of the new and untried, preferring to protect existing broadcast revenue rather than push boundaries. This is changing, particularly among smaller rights holders who are locked out of the big-ticket media deals. But, according to Michael Broughton of Sports Investment Partners, it remains sluggish: “MLBAM is a classic example of something that would never happen on this side of the Atlantic. Many sports still fear the Internet and IPTV — yet broadcast revenue for MLB has gone up considerably even whilst BAM grows … something for the cynics to examine carefully.”

Then there’s the money. London is one of the great financial sectors in the world, but the city has been slow to come to the tech party. There are attempts afoot to bring the geeks of Shoreditch and the city bankers together, but don’t expect a Silicon Valley gold rush. These two tribes may share a postcode, but they live in different worlds.

Squawka

Squawka is part of the race to own and monetize the second-screen experience in the sports sector and markets itself around the tag line: “Stats Worth Sharing.” Squawka received funding from advertising agency BBH and has an official relationship with data specialist Opta to offer all manner of stats, performance and real-time conversation pieces. It calculates more than 14 million data points in real time, offering live statistics on teams and players, and allows users to filter statistics by any five-minute period in the game. The data panels are fully shareable on Facebook and Twitter.

Seven League

|

Seven League ran social media around last year's Big Game 5 rugby match at Twickenham Stadium.

Photo by: Seven League |

The need for expert counsel in the digital space has never been higher with the prospect for false investment and wasted money prominent on the worry list of sports rights holders, media and brands. Nowhere is this more relevant than in the area of data. Seven League, the sector’s hot indie agency building a track record of work around the concept of “datatainment,” is going further than most in interpreting what all that data means. Created and led by Richard Ayers, the European sports sector’s digital thought leader, the agency has created interactive products that use performance data to entertain sports fans and help clients, including Manchester City, the England and Wales Cricket Board, and BT Sport, to broaden their commercial offer.

Ticketscript

Founded by Dutch entrepreneur Frans Jonker in 2006, Ticketscript was the first to introduce e-ticketing successfully to the Dutch and German event industry. Since then it has gained traction in the sports event market across the continent by helping rights holders to build on their fan communities via online and mobile solutions. The company’s main markets are music events, but Ticketscript has a growing sport portfolio including the Euro Hockey League and BMX Masters events, among others.

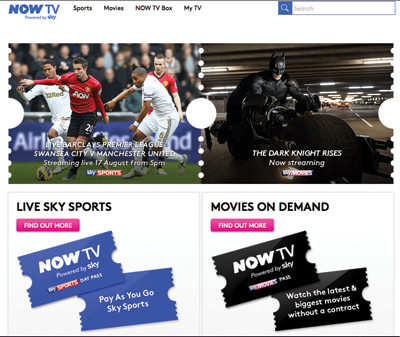

Now TV

Sky Sport’s first major move into the pay-as-you-go and on-demand sports market provides a flexible way for sports fans to watch Sky’s unrivaled sports rights portfolio. This is essentially a Netflix option for sports fans, opening a new revenue stream to add to Sky’s 10 million-subscriber base. It means that Premier League soccer, Ashes cricket and Masters golf can be streamed to mobile devices and platforms such as the Sony PlayStation. An initial promotional campaign saw 25,000 customers sign up to Now TV in the first three months, BSkyB said.

Supponor

This technology allows rights holders to offer closely targeted, virtual perimeter board advertising. Finnish in origin and backed by Sports Investment Partners in London, Supponor’s DBRLive system superimposes advertisements on the boards on a region-by-region basis. It relies on the quality of the domestic television feed to work properly and was let down by Globo, the domestic Brazilian broadcaster, on its big debut for the Brazil vs. England friendly this summer from the Estádio do Maracanã. A hitch certainly, but it feels like the future.

Rightster

As sports rights holders seek to monetize online content channels, Rightster’s star continues to rise. Led by Charlie Muirhead out of London, the company was recently chosen by rights house MP & Silva to create and manage YouTube channels for the Italian agencies’ extensive sports portfolio, including leagues and federations. Rightster takes the content and applies it to nascent markets for video content such as integrated betting services for bookmakers, video content for newspapers, and with live and on-demand video access for broadcasters.

Fanatix

There’s a conundrum at the heart of the race to own the second-screen experience: What happens when there’s no game to watch? Many apps have come and gone, but Fanatix, launched in October 2011 by sports tech veteran Will Muirhead, seems to be navigating the central issue of remaining relevant to users 24/7. Fanatix’s initial iteration was as a group messaging app for sports fans. This has since evolved into one of several second-screen “social TV platforms for sports” aimed at couch potatoes. Fanatix gained traction through creative partnerships with online betting site Paddy Power for May 2012’s Champions League final and with Eurosport for summer tennis, motorsports and cycling events. Throw in Twitter feeds and news aggregation and Muirhead’s relaunched Fanatix aims to “reimagine the back page,” an idea that attracted $1 million of new funding, doubling its existing investment total.

Perform

The market leaders in video content production, Perform broadcasts official sports highlights and news globally on more than 600 websites, including many leagues, teams and federations. Joint CEO Oliver Slipper runs the London-based company. Current highlights and news content available on Perform’s ePlayer include FIFA and UEFA football internationals, the NBA, ATP World Tour, WTA Tour, Aviva Premiership and RBS Six Nations rugby, England home cricket internationals, LV= County Championship cricket, and European Tour golf.

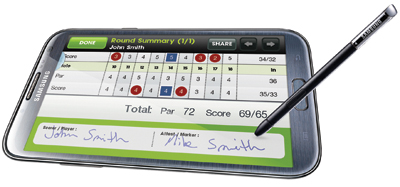

Golf Gamebook

Few sports are as conservative as golf, but the potential for tech to enhance the experience of fans, viewers and participants is enormous. Into this space come several European startups, the most notable being Golf Gamebook, an online handicapping and social media platform, and VPar, a live scoring platform. Meanwhile, major players such as IBM and SAP are circling the pro tours seeking a way in to showcase their technology. This will test the game’s famously technology-shy rights holders.

Richard Gillis writes the Unofficial Partner blog and covers the sports business for the Wall Street Journal in London. Follow him on Twitter @RichardGillis1.