There once was a time when you could watch a NASCAR race and see cars representing the Navy, Marines, Army, National Guard and Air Force. But turn on a race today and odds are the only branch of service that will be visible on the hood of a car is the National Guard.

The absence of the Army, Navy and Marines, which dropped their team sponsorships in recent years, and the Air Force, which reduced its sponsorship of Richard Petty Motorsports to two races, is indicative of the budget pressures on the U.S. military.

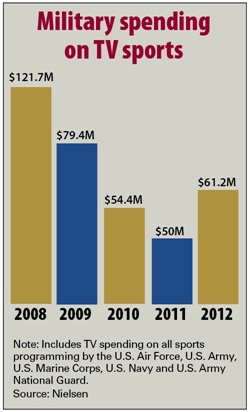

Over the last five years, military spending on advertising has plummeted, and the sequester, which eliminates nearly $100 billion in military spending over the next two years, is expected to make things worse.

|

The National Guard spends $26.5 million to sponsor Dale Earnhardt Jr.'s No. 88 car with Hendrick Motorsports.

Photo by: GETTY IMAGES

|

A category that once contributed nearly $100 million in sports sponsorship rights in 2008 has shriveled to just $50 million over the last five years, according to estimates by the sponsorship-monitoring service IEG. There have been similar reductions in military advertising on sports television.

Look around sports today and you can see the repercussion of those decreases. Over the last five years, the Marines Corps cut its UFC sponsorship, the Navy has bought less advertising during NFL games, and the U.S. Army discontinued its sponsorship of the NHL, PBR and NASCAR’s Stewart-Haas Racing.

It’s a reflection of diminishing budgets. Since 2008, the Navy’s ad budget has fallen 37 percent, the Army’s 50 percent, the National Guard’s by 43 percent and the Marines’ by 32 percent. Only the Air Force has seen an increase in its advertising budget, but it currently devotes only $2 million to sports.

A reduction in military spending following the wars in Iraq and Afghanistan drove those advertising cuts and triggered the elimination of several sports sponsorships and reductions in TV ad buying.

And everyone fears that it’s going to get worse after the sequester.

“The sports investment as a piece of the pie is stable, but the pie has gotten smaller,” said John Myers, U.S. Army director of marketing. “The problem is the pie is shaky. It’s shaky near the crust around the edges [where marketing dollars sit]. You have to develop some ‘what ifs.’”

Military spending doesn’t make up a large portion of sponsorship or TV advertising dollars in sports. But the armed forces do support several notable properties such as the U.S. Army All-American Bowl, regarded as the premier high school football all-star game, and Dale Earnhardt Jr.’s No. 88 National Guard Chevrolet. While the Army and National Guard say those sponsorships are safe, recent budget reductions and the looming sequester has many anticipating the marketing dollars spent to support those programs could be affected.

“They’re not going to be able to activate as aggressively,” said Matt Petersen, vice president of client leadership at IEG. “You’ll see them at fewer events and with smaller footprints. They’ll try to do more with less.”

■ ■ ■

Ask military marketers what effect the sequester will have on their budget and the answer is unanimous across every division of the military: They don’t know.

The military put off cutting $41 billion from its budget this year because it anticipated the sequester would be postponed. But now it needs to find a way to make those cuts and reduce next year’s budget by an estimated $52 billion.

Military marketers anticipate decreases in their advertising budgets as a result. Army marketers have begun developing multiple budgets for next year so they can be prepared when the cuts come. Other branches are waiting to see how severe the cuts will be before finalizing their budgets.

Military budgets for advertising and recruiting range in size from $130 million at the Air Force to $507 million at the Army (see chart). The amount dedicated to sports varies from 1 percent at the Air Force to 22 percent at the Marine Corps.

Those percentages haven’t changed as advertising budgets decrease, but the amount available has shrunk, and advertising and recruiting leaders expect it to contract more in the coming years.

“We’re entering uncharted waters in terms of impact and how steep the cuts will be due to sequestration,” said Gen. John Horner, the Air Force’s recruiting service commander. “Our marketing funding [dollars] are some of the first that are cut. We are seeing a lot of our goals for outreach potentially cut.”

The effect the sequester will have on sports remains unclear. Military marketers across all branches believe sports provide a valuable tool for reaching new recruits, but the way they use sports varies.

The Army and National Guard rely heavily on traditional sports sponsorships, but their spending in sports has changed in recent years.

|

The U.S. Army All-American Bowl for top high school players is one of the notable sports properties that draws military marketing dollars.

Photo by: ICON SMI

|

The Army spent as much as $30 million on sponsorship rights alone in 2008, according to IEG, but reduced its sports spending to a third of that over the last few years by eliminating its multirace sponsorship of Stewart-Haas Racing and its NHL, AFL and PBR sponsorships. It continues to sponsor the U.S. Army All-American Bowl and Don Schumacher Racing’s NHRA team, and it complements that with digital media buys across MLB.com.

The National Guard, which ended its sponsorship of the AFL, sponsors Hendrick Motorsports’ No. 88 car, Panther Racing’s IndyCar team and AMA Pro Road Racing.

The Navy and Marines have fewer sponsorships and do more advertising in sports. The Navy sponsors the X Games, an advertising-heavy sponsorship with ESPN, and it complements that with TV ad buys during college sports and NFL games. The Marines Corps has no national sponsorships but spends $13.2 million on TV, digital and print ads tied to sports.

The Air Force spends the least on sports out of any military branch. It is an associate sponsor of Richard Petty Motorsports’ No. 43 car but does no advertising during sports broadcasts because entertainment ad buys are less expensive.

“We look for where young prospects are spending time, and sports is a passion point,” said Dan Weidensaul, the Marine Corps’ deputy assistant chief of staff for advertising. “We use marquee sports programming to launch key campaigns.”

The reason many of the branches concentrate on motorsports is because Army research shows that half of motorsports fans have previously expressed interest in joining the military and they are 27 percent more likely to join the military than non-motorsports fans. The Air Force uses motorsports because it has to recruit 9,000 mechanics, and its research shows that it is more likely to find such recruits among motorsports fans.

NASCAR remains a top choice for the Air Force and National Guard, which spends $26.5 million to sponsor Earnhardt, because it offers a 10-month season with races that go to more than a dozen states.

“NASCAR has a huge reach,” said Lt. Col. Michael Wegner, the National Guard’s marketing chief. “It allows us to brand and reach down to community activities.”

The Army, which became the first official military sponsor of NASCAR in 2003, cut its NASCAR team sponsorship last year and narrowed its focus to its sponsorship of the NHRA, which was less expensive and, Myers said, delivered a better return on investment.

“That was a tough decision,” Myers said. “It was based on … the pie growing smaller.”

■ ■ ■

During a recent NHRA race, U.S. Army Sgt. 1st Class John Steele scooped up a brochure for “The Making of a Soldier” and walked over to greet a woman who entered the Army’s activation corral. He escorted her to a padded, pushup station.

“In the Army, it’s not just about strength,” Steele said, as the woman kneeled down to do a pushup. “It’s being mentally strong. Give me one good pushup and get a T-shirt.”

|

The Army has stuck with its sponsorship of Don Schumacher Racing’s NHRA team, citing return-on-investment figures.

Photo by: AP IMAGES

|

It was one of 100 T-shirts Steele and his colleagues gave away the first day of the race. They spoke to more than 20 potential recruits and landed five recruiting appointments, putting them on track over the next two days to exceed the number of contracts they signed in 2012 when they signed eight Army recruits.

The Army will take its NHRA promotion to more than 20 markets this year. Its activation will be consistent across every one, largely because it opted to eliminate its sponsorship of Stewart-Haas Racing in NASCAR.

“Our ability to use the NHRA sponsorship for activation was a better ROI for us,” Myers said.

Being able to pinpoint the return on investment of a sports sponsorship has taken on increasing importance for all branches of the military. They came under attack last year in Congress when Rep. Betty McCollum, D-Minn., and Rep. Jack Kingston, R-Ga., sponsored an amendment to cut $72 million from this year’s defense spending bill by eliminating professional sports sponsorships. The amendment was defeated by just 14 votes, but its message was clear.

“The less money we get, the more we have to figure out where we get the most bang for the buck,” Air Force Gen. Horner said. “The price is too dear [for sports] as you get less and less money.”

Different branches have responded in different ways. The Army cut its Stewart-Haas Racing sponsorship, the Marines Corps cut its UFC sponsorship, and the National Guard moved to prove that its sponsorship of Hendrick Motorsports was a worthwhile investment.

The Guard hired Alan Newman Research of Richmond, Va., to conduct a study of its investment in motorsports. The agency determined that 90 percent of Army National Guard soldiers who enlisted or re-enlisted since 2007 were exposed to the Guard through recruiting or retention materials featuring NASCAR cars and/or drivers.

“It absolutely is of value to us,” Wegner said, but he acknowledged that the pressure to prove that has increased. “As for the future of NASCAR, we love what we get for the program. But if Congress makes decisions about budgets, we’re going to have to make hard decisions about how we spend our dollars.”

■ ■ ■

Doug Berman has been working closely with the Army ever since his company, All American Games, launched the U.S. Army All-American Bowl in 2001. He’s confident the Army will continue to spend an estimated $2.5 million to be the title sponsor of the game in the future because it gets a strong return on its investment, but he admits he’s uneasy about the sequester cuts.

“One would be foolhardy if one deals with the federal government to not be cognizant that the federal budget is under pressure,” said Berman, who was the state treasurer of New Jersey in the 1990s when the state had to cut $2 billion out of its budget.

TV networks are more insulated from the looming sequester cuts than properties and teams because they’re less dependent on military advertising. While it feels like ads for the Navy, Air Force, Army, Marines and National Guard dominate sports broadcasts, the truth is that it’s a very small component of the TV ad marketplace and it’s decreased considerably over the last five years.

Collectively, the five largest branches of the military spent just $61 million on ads during sports broadcasts in 2012, a 50 percent

|

The Navy continues to sponsor the X Games (above), while the Army has ended several deals, including one with Stewart-Haas Racing.

Photos by: GETTY IMAGES (2)

|

reduction from 2008, according to Nielsen (see chart). As a result, sellers of sports advertising inventory aren’t concerned about the sequester and potential cuts to military budgets.

“It’s not a significant enough category [for the sequester] to affect us one way or the other,” NBC’s Seth Winter said.

Sports properties like Berman’s All-American Bowl are taking a page from TV broadcasters and diversifying in order to avoid major cuts to their budget after the sequester. No one wants to be in the situation that Stewart-Haas Racing found itself in last year when it lost more than $6 million in sponsorship support from the Army, which had spent as much as $13 million annually with the team in prior years. The team still has six Sprint Cup races to sell this year as a result of the Army’s decision to walk away.

“We were surprised it happened but prepared,” said Brett Frood, Stewart-Haas Racing’s executive vice president. “When you’re partners with them, you understand there are annual looks at the budget and political undertones to decisions.”

Part of the reason Frood was surprised by the decision is because of the way the military makes advertising commitments. Military branches can’t sign multiyear deals because of congressional rules about spending commitments, so properties and teams have to wait until the summer or fall to confirm renewals with the Army, Navy or another branch.

“Is it ideal? Probably not,” said Pat Perkins, Hendrick Motorsports’ vice president of marketing. “But it’s such a worthwhile partnership because there’s a lot of pride in representing the military.”

It’s that pride that makes driver Tony Schumacher willing to make sacrifices and cut his own drag racing team’s budget in order to preserve its primary sponsorship from the U.S. Army, which spends more than $5 million to sponsor the team and NHRA.

“We know that we can cut certain things,” Schumacher said. “We’ve found a great partnership that works and we’ll find a way for it to keep working.”