Twitter last month made a significant announcement at the end of Internet Week in New York, unveiling a long list of new content partners for its new in-stream advertising program, newly dubbed Twitter Amplify.

What initially had been tested with ESPN and Turner Sports has now been expanded to more than a dozen additional sports and media entities, including MLB Advanced Media, the PGA Tour and Time Inc. In Twitter Amplify, content owners have a platform to post short video clips, such as near real-time highlights, and connect them with sponsors.

|

Insurance carrier Esurance sponsors Social Media Night with the Golden State Warriors.

Photo by: Golden State Warriors |

Revenue from Twitter Amplify is split between the content owner, distributor and Twitter. The initiative, marking perhaps Twitter’s boldest push yet toward becoming a moneymaking force, is fueling independent projections of the company reaching $1 billion in annual ad revenue by next year.

“Brand advertisers get, for the first time, an integrated cross-platform tool for reaching the social conversation wherever it happens,” said Glenn Brown, Twitter director of promoted content and sponsorships.

But beyond just a straightforward corporate announcement, the advent of Twitter Amplify delivered something else, something potentially much bigger and more important: another major road map toward generating meaningful revenue through social media.

Much has been said, done and written around the power and utility of social media in sports to boost fan affinity and indirectly aid traditional revenue lines such as ticket and merchandise sales, TV viewership and concessions. And those gains continue to be made across the sports industry and grow more meaningful.

As social media continues to build and mature, though, efforts such as Twitter Amplify now give further evidence that the medium itself can be a powerful destination for corporate sponsorship and scalable advertising revenue, and one far beyond just a throw-in to a larger media buy on traditional platforms or an isolated, oft-ignored execution such as a promoted tweet.

“There is a lot that can be done around the visualization of social,” said Christina Miller, NBA Digital senior vice president and general manager. NBA Digital, a partnership between the league and Turner Sports, recently started #NBARapidReplay on Twitter with short video clips of playoff highlights, with initial sponsors Sony, Taco Bell and Sprint running both pre-roll video ads and branded border ads below the in-stream video player. Those borders additionally contain links to follow the sponsors’ own Twitter feeds.

Turner Sports, which also manages March Madness Live and the NCAA’s digital operations, in March aided Coke Zero on a similar, social media-oriented ad campaign.

“These are highly engaged, target audiences that we have aggregated on social, and sponsors in fast-increasing numbers are now asking to be part of that,” Miller said.

Built around fan affinities

The acceleration of social media sponsorship stems from two primary factors: mass recognition of the sizable audience scale now possible through the medium, and a focus on sports brands as a key point of entry as opposed to social media by itself.

Most industry executives would agree that simple follower and fan counts on social media do not tell the whole story of the depth of one’s impact in the space, and that engagement metrics are also critical. But for many leagues and teams, social media reach is now beginning to rival that of traditional platforms.

The NBA now boasts more than 300 million combined fans and followers around the world on social media. European soccer power FC Barcelona by itself has more than 59 million combined Twitter followers and Facebook fans. The list goes on and on as dozens of teams are well into seven figures on their own social media counts — figures far higher than the annual attendance or a TV audience figure for most individual teams.

And those audiences are highly engaged, as research firm BI Intelligence estimates that the average American spends 12 hours a month on social media, with those in the coveted age 18-24 demographic averaging 20 hours per month.

Television, of course, remains by far the dominant form of ad spending, in terms of gross revenue. But many industry estimates point to a continued mushrooming in digital ad revenue, including an eMarketer projection of nearly $48 billion in total annual U.S. digital ad spending by 2014, more than 50 percent above the figure of just two years ago, with social media claiming a meaningful slice of that money.

“What was before a nicety, a luxury, is now a necessity,” said Chip Bowers, Golden State Warriors chief marketing officer. “A lot of categories are now very focused on social media, big categories like airlines, banking and financial services, and they’re now going where the audience is and where that audience is spending fast-increasing amounts of time.”

Added Jayne Bussman-Wise, digital director for the Brooklyn Nets and Barclays Center, “Partners are now asking for this, because very often they’re active now in social media in their own business. It’s as simple as that. So it’s our job to help them activate.”

And those activations have run the gamut from branded social destinations, newly created inventory such as the Twitter Amplify videos, event-based marketing efforts and themed giveaways such as the Warriors’ Social Media Night, and more traditional athlete endorsements that carry a specific social media focus.

But both Facebook and Twitter have found that placing advertising on the platform itself is still a tricky situation, and fans frequently balk if the marketing becomes too overt or too frequent on what they consider a very personal space.

As a result, efforts such as Twitter Amplify represent a recognition that fans rally foremost around their teams and leagues, and those passions in turn can be the main avenue toward more delicately inserting short pre-roll and post-roll video ads.

“It has to be done through fan affinities,” said Bob Bowman, MLB Advanced Media president and chief executive. MLBAM is among the newly signed partners of Twitter Amplify, and soon plans to begin running sponsored video clips through the platform. “You have to have real content be the anchor. This seems to be the right solution. Time will tell if we’re right, because this is all fresh snow. But it looks like it has all the right ingredients.”

Measurement search

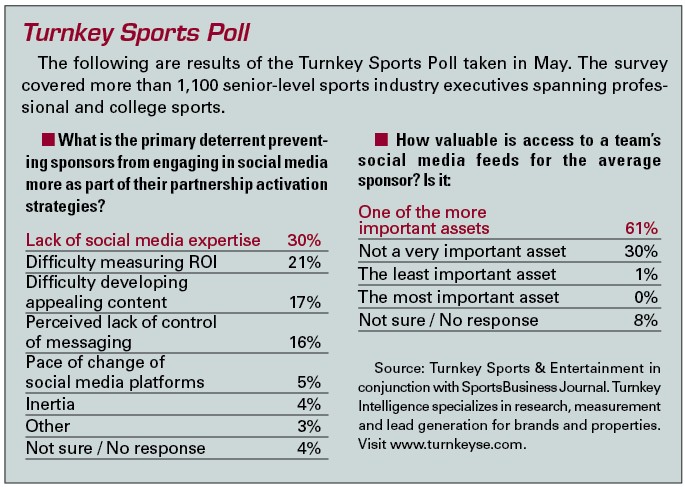

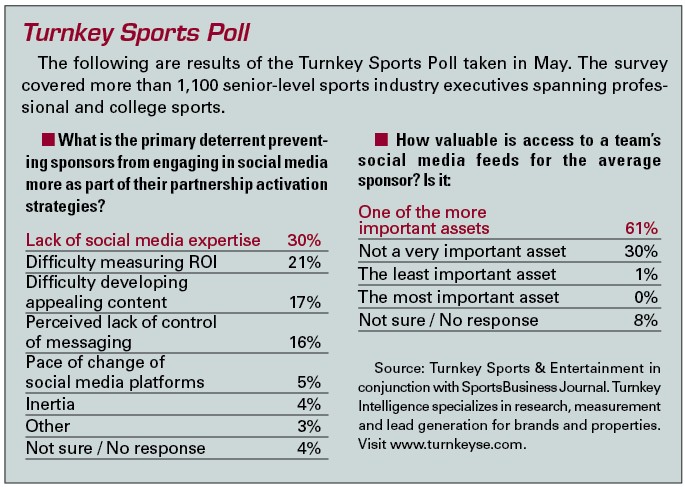

While there is now little debate about the power of social media advertising, finding effective, widely accepted means of measuring advertising effectiveness and showing return on investment is anything but settled. And the lack of any sort of standardized measuring tools will likely be something of an inhibiting factor on the acceleration of social media spending, at least in the short run.

|

| The newly launched Twitter Amplify platform inserts banners and brief pre-roll and post-roll video ads. |

Audience measurement tools in other media, such as Nielsen TV ratings, comScore digital metrics or Arbitron totals in radio, all have their flaws and their own critics. But in those mediums, they have widespread acceptance as a baseline tool to help set advertising rates.

No such commonly used metric exists for social media.

“The only thing that most brands ask about is the number of followers, and that’s so misleading,” said Jeff Weiner, president of ESBL Social Media, which has struck numerous deals connecting brands and athletes in social media. “There’s still not enough differentiation between quantity and quality, and recognition of things like retweets and who gets their social media content picked up in traditional media.”

Insurance carrier Esurance, which sponsors Social Media Night for the Warriors (see related story), and estimates that 50 percent of all its sports spending is activated through social media, acknowledges that the ROI metrics of its deals are still a bit fuzzy. But the company, aided by its own status as an online commerce outfit and active presence in social media, is accepting the ambiguity.

“We don’t have it down to a science. It’s certainly a little more subjective,” said Darren Howard, Esurance vice president of marketing. “It’s a different approach, but we are definitely seeing more customer leads and stronger engagement in our customer acquisition efforts.”

But as each of the major social media portals, including Twitter, Facebook and Instagram, further embrace the notion of large-scale partnership, the development of richer social media analytics is likely soon to follow. Also likely to the help is the creation of better measurement of mobile traffic in general, something still in its formative stages but for many destinations such as Twitter has approached or even surpassed half of its total audience.

“There are going to be different solutions for different platforms,” Bowman said. “The thing for us to get the user experience in all these areas right first, get fan adoption where we want it to be. We do that and the revenue will follow.”

Most popular teams on social media

| TOP 10 OVERALL |

| 1 |

Los Angeles Lakers |

16,341,062 |

3,134,017 |

19,475,079 |

| 2 |

Chicago Bulls |

8,661,902 |

822,658 |

9,484,560 |

| 3 |

Miami Heat |

8,101,454 |

1,319,424 |

9,420,878 |

| 4 |

Boston Celtics |

6,926,428 |

1,106,161 |

8,032,589 |

| 5 |

New York Yankees |

6,345,314 |

903,516 |

7,248,830 |

| 6 |

Dallas Cowboys |

5,388,264 |

565,232 |

5,953,496 |

| 7 |

Pittsburgh Steelers |

4,859,038 |

543,164 |

5,402,202 |

| 8 |

New England Patriots |

4,022,135 |

598,757 |

4,620,892 |

| 9 |

New York Knicks |

3,725,566 |

631,581 |

4,357,147 |

| 10 |

Boston Red Sox |

3,814,001 |

471,603 |

4,285,604 |

| TOP 5 MLB |

| 1 |

New York Yankees |

6,345,314 |

903,516 |

7,248,830 |

| 2 |

Boston Red Sox |

3,814,001 |

471,603 |

4,285,604 |

| 3 |

San Francisco Giants |

1,691,037 |

430,257 |

2,121,294 |

| 4 |

Philadelphia Phillies |

1,303,345 |

761,298 |

2,064,643 |

| 5 |

Chicago Cubs |

1,766,044 |

241,694 |

2,007,738 |

| TOP 5 NBA |

| 1 |

Los Angeles Lakers |

16,341,062 |

3,134,017 |

19,475,079 |

| 2 |

Chicago Bulls |

8,661,902 |

822,658 |

9,484,560 |

| 3 |

Miami Heat |

8,101,454 |

1,319,424 |

9,420,878 |

| 4 |

Boston Celtics |

6,926,428 |

1,106,161 |

8,032,589 |

| 5 |

New York Knicks |

3,725,566 |

631,581 |

4,357,147 |

| TOP 5 NFL |

| 1 |

Dallas Cowboys |

5,388,264 |

565,232 |

5,953,496 |

| 2 |

Pittsburgh Steelers |

4,859,038 |

543,164 |

5,402,202 |

| 3 |

New England Patriots |

4,022,135 |

598,757 |

4,620,892 |

| 4 |

Green Bay Packers |

3,467,521 |

461,898 |

3,929,419 |

| 5 |

New Orleans Saints |

2,938,403 |

320,591 |

3,258,994 |

| TOP 5 NHL |

| 1 |

Boston Bruins |

1,354,437 |

360,362 |

1,714,799 |

| 2 |

Pittsburgh Penguins |

1,290,056 |

385,702 |

1,650,418 |

| 3 |

Detroit Red Wings |

1,377,301 |

301,339 |

1,678,640 |

| 4 |

Chicago Blackhawks |

1,282,458 |

332,007 |

1,614,465 |

| 5 |

New York Rangers |

1,029,470 |

236,947 |

1,266,417 |

Source: SportsBusiness Journal research