Four years ago, my colleague

Michael Smith and I heard a rumor that

ESPN was offering $495 million to pick up the BCS rights over four years.

The number sounded so ridiculously high — a full $100 million more than incumbent

Fox was offering — that we hesitated publishing it, even though we had multiple confirmations.

That figure — an average of $124 million per year — sounds quaint now, especially considering that late last year, ESPN agreed to pay an average of $500 million per year just to renew it.

As has been the case with every big media rights deal over the past decade, the initial BCS announcement in 2008 prompted some to speculate that sports rights finally had hit a ceiling — that ESPN’s bid was so massive that either the government would get involved to protect consumers or the market would correct itself.

Today, the same situation is happening in Los Angeles, where Time Warner Cable’s recent Dodgers deal — $8 billion over 25 years — has brought out the same speculation. How can sports rights go any higher?

Network and league executives privately say that we are still nowhere close to a rights ceiling, and they believe rights fees will continue to climb for the foreseeable future. Taking a look at the TV market as a whole, it’s difficult to argue with them.

■ Entertainment TV is a disaster.

Even with rights fees now in the billions of dollars, sports is nowhere near as risky as entertainment programming. A quick look at the current TV season shows why.

|

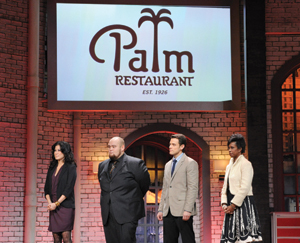

With new shows such as CBS’s “The Job” getting the ax quickly, broadcasters see sports as a safer bet.

Photo: GETTY IMAGES

|

Broadcasters invested in 98 scripted series this season, 70 percent of which will never make the air, according to AdWeek magazine.

Even if a series finds a home on a TV network, it has an awful success rate. When CBS canceled “The Job” after two episodes last week, it brought the number of new series canceled this season to 10. That is not the kind of environment where people want to invest.

It’s certainly cheaper to fund a pilot and a series. But network executives have no idea what will be popular and lack the patience to stick with shows that don’t start strong.

Sports, on the other hand, is relatively stable, even after a year where the biggest leagues saw viewership drops. NFL viewership was down on CBS, ESPN, Fox and NBC this season. NBA viewership on ESPN, NBA TV and TNT is down so far this season. MLB games were down on ESPN, Fox and TBS in 2012.

But those ratings dips do not concern network executives. NBC’s “Sunday Night Football” may have been down this season, but without it, NBC’s prime-time performance has tanked. Network executives know — within a few ratings points — what kind of numbers sports will bring. TV executives would rather invest in established sports brands and stars than take a flier on a series like “The Job.”

■ More networks are bidding for the rights.

Much has been made of the new national sports networks — CBS Sports Network, Fox Sports 1 and NBC Sports Network — that are bidding up rights. But the most competition these days is at the local level. Fox Sports, Comcast, DirecTV and Time Warner Cable own multiple RSNs. Teams are continuing to look into setting up their own networks. The competition to pick up local rights is increasing, which means media deals at the local level will continue to escalate at a big clip.

■ Consumers are still paying.

Cable operators and satellite companies increase prices every year, and consumers keep coming back. While more options for Internet video exist than ever before, network chiefs and distribution executives insist that consumers so far have been unwilling to cut the cord. This is the area I’ve been watching the closest. If prices get so high that consumers decide to drop their subscriptions, changes will be made and costs will have to come down. But that’s not likely to happen any time soon.

John Ourand can be reached at jourand@sportsbusinessjournal.com. Follow him on Twitter @Ourand_SBJ.