In-Depth

The road to $25 billion

Where could the NFL's growth come from?

Without inside access to the NFL’s books, it’s tough to know exactly how to create a pie chart for the league’s $9.5 billion of revenue in 2012. We do know from the 2011 season that of the year’s nearly $9.4 billion in revenue, $5.5 billion (58.5 percent) came from national money like media, sponsorship and NFL Ventures. That is public because the Green Bay Packers, as the only public NFL team, annually disclose some financial reports. Below is a description of different league business lines and how they are faring.

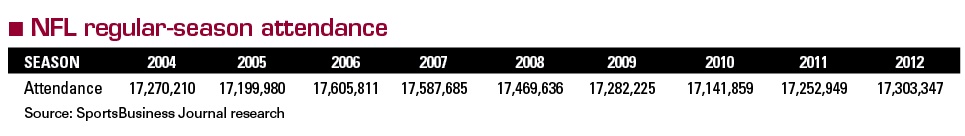

Ticket sales

Still the bread and butter of most teams’ local business, this revenue has largely been flat for several years for many clubs, if not down. Like other businesses, the NFL has struggled through the financial problems the country has suffered since 2008. While the league has filled most of its stadiums, prices have been restrained, so ticket revenue has been very modest, said the NFL’s Eric Grubman. This area could get a boost with new stadiums in Santa Clara and Minnesota, and would get a big bump if a team relocated from a small market to Los Angeles.

Licensing and merchandise

|

| Photo by: Getty Images |

This segment of business is doing very well, according to Grubman, because of the influx of new partners such as Nike, New Era and VF. “Online merchandising is on fire. Our team stores are on fire,” he said.

Sponsorship

Sponsorship revenue has not dipped in the last few years, which itself is a major accomplishment in a tough economy. The league just sold the quick-service restaurant category to McDonald’s and there may be some opportunities in the new TV contracts, Grubman said, though he declined to elaborate. There also could be more opportunities to sell coveted space on field, including uniform patches.

|

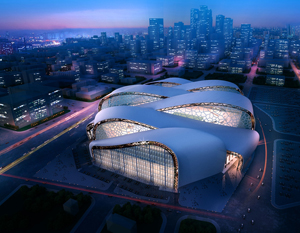

New stadiums planned for the Minnesota Vikings (above) and the San Francisco 49ers will bring a boost in league revenue.

Photo by: Minnesota Vikings |

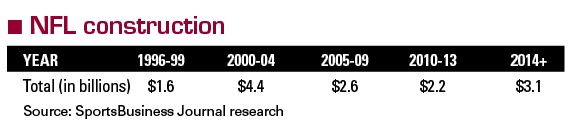

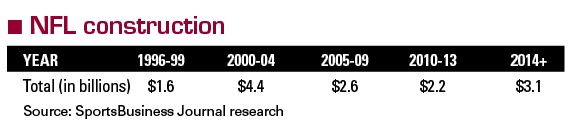

Stadiums

Stadium building went through a boom in the late 1990s and through much of the first decade of the 21st century. But when the league’s stadium financing plan expired, labor strife doomed any possibility of a quick successor agreement between the union and league. The 2011 CBA allowed for a new stadium plan, and now new projects will come online in Santa Clara, Calif., and Minnesota, with renovations planned at Green Bay, Pittsburgh, Carolina, Buffalo and Miami.

|

Venture fund

The league two years ago announced plans for a venture capital fund. However, it is more apt to describe the fund today, which has yet to invest, as a private equity fund. The league has switched focus from early-stage startups to more established businesses in which to invest. That moves it away from the province of the venture capital world and into the private equity stage. The league will not be taking control stakes, however.

Media

The jump in new media money in 2014 is no secret, though it is staggered so the initial years will not see a major jump.

|

| Photo by: Getty Images |

How the league handles distribution through alternate platforms, like mobile and tablet, could provide the key for the league reaching its $25 billion revenue goal. NFL Network and RedZone also look to be key in getting the league to the revenue target. Grubman talked about new stats products that the league can sell. Tom Spock, a media consultant and former league executive, agreed: “There are data streams they can monetize in gaming, fantasy.”