| |

| Writers David Broughton and Bill King on how political campaigns have spent their money in sports. |

In the weeks leading up to the Republican National Convention, viewers in Tampa who tuned in to the Summer Olympics learned that Usain Bolt was the world’s fastest man, that Gabby Douglas could defy gravity and that Mitt Romney had a plan to put Americans back to work.

In September, fans watching football in Cleveland saw their Ohio State Buckeyes win five times, their Browns lose four times, and President Barack Obama approve this message 166 times.

Campaign advertising has taken over the airwaves as never before this presidential election season, with analysts estimating that television spending by the two sides and the political action committees that support them will exceed $1 billion, almost all of it pouring into a dozen battleground states set to determine the winner.

More than ever before, political analysts say, that spending has made its way beyond its traditional place on news and talk shows and onto the air occupied by a state’s favored teams.

And so, in Florida, where the race for 29 electoral votes remains tight, the two campaigns and the PACs spent $5.7 million for 1,360 spots on network affiliates in the five largest markets in the 10 critical weeks that began in August — on sports alone.

In Ohio, the total for sports spots on network affiliates in Cleveland, Cincinnati and Columbus in that period reached $3.78 million and 915 spots.

They bought heavily in NFL games, in college football and during the Olympics, and dabbled in baseball, NASCAR, tennis and golf.

Over the past three weeks, SportsBusiness Journal reviewed and analyzed more than 5,000 purchase orders, contracts and invoices filed with the Federal Communications Commission by stations in 21 markets covering nine battleground states from Aug. 2 to Oct. 12 — documents that before a recent FCC mandate were available only by request at station offices.

|

Basketball fan Obama (with NBA’s Adam Silver and Nike’s Charlie Denson) is a strong presence on college football.

Photo by: GETTY IMAGES

|

What emerged was a portrait of sports programming as a comparably small, but strategically played, segment of the media buying landscape in the chase for the White House.

The campaigns spent $13.6 million in the nine perceived battleground states we examined: Florida, Ohio, North Carolina, Colorado, Wisconsin, Michigan, Pennsylvania, New Hampshire and Minnesota. All but $2 million came from the first four states on that list. We did not review records from the projected battlegrounds of Virginia and Nevada.

“Sports is a significant piece of the puzzle because it’s one of the last bastions of undecideds or passive late-deciding voters,” said Elizabeth Wilner, vice president for strategic initiatives at Kantar Media’s campaign analysis group, which

|

Romney (at Richmond this month) is in NASCAR more than the president.

Photo by: GETTY IMAGES

|

tracks media spending in politics. “And because of the coincidences of the sports calendar, you have major sporting events in the weeks leading up to Election Day.

“In the markets where the candidates are still active, you’ve got a lot of sports fans.”

The heaviest play came in the most-watched sports programming of the campaign season: The NFL, where the campaigns and PACs spent $7.85 million for 1,365 spots; the Olympics, where they dropped $3.04 million for 760 spots crammed into two weeks; and college football, where they spent $2.05 million for 872 spots.

With only a few Saturday afternoon Fox games and advance buys of the postseason on its national menu, MLB was a distant fourth at $211,490 for 93 spots, with 73 percent of that coming in Florida. Golf telecasts brought in $165,660 for 123 spots, U.S. Open tennis $141,895 for 147 spots, and NASCAR $127,900 for 73 spots in two ABC prime-time races.

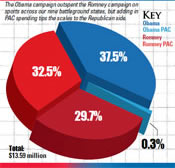

In the 21 markets, Obama’s campaign outspent Romney $5.1 million to $4 million on sports, but the spot count was nearly even, with Obama leading 1,291 to 1,224. Romney’s PACs tipped the overall scale heavily in his favor, adding in 888 spots for $4.4 million.

FCC rules entitle campaigns to the lowest rate offered for a given class of ad time, allowing them to pay far less than many advertisers. The campaigns also frequently agree to be pre-empted without notice, cutting the price even more. PACs must negotiate market rates.

The choices varied not only by state but by markets within states.

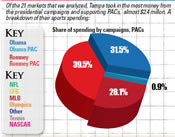

The campaigns and PACs spent $2.4 million in Tampa and $1.8 million in Orlando, but only $515,000 in Miami, the largest market of the three. They combined to spend $150,110 on MLB in Tampa — where the Tampa Bay Rays aired on Fox during the pennant race — but no more than $16,000 on the sport in any other Florida market. Romney spent more on NFL games in Orlando, Miami and Jacksonville, but Obama spent more on it in Tampa and West Palm Beach.

The director of the Obama campaign’s spot buying operation, GMMB partner Brad Perseke, declined comment for this story, saying the firm does not discuss client work. The Romney campaign did not respond to interview requests. But political media strategists said none of the market-by-market variances were happenstance. The emergence of big data and the growth of buying operations has allowed campaigns to target voters more specifically. That data has drawn campaigns to sports programming, and to specific plays within it.

Craig Sloan, senior vice president of national advertising sales for Home Team Sports, said his RSNs are seeing more political activity than they did in 2008. Sloan said the difference mirrors the increased money advertisers are spending on sports.

“Sports wasn’t always relevant to political campaigns,” Sloan said. “As the environment has changed in the marketplace and sports has taken on more prominence, they have come to pay more attention to it. … Two years from now, I’d anticipate that we’ll be having even more success because it’s just a mindset that they are starting to believe.”

The local focus

As in past years, the presidential candidates have stayed clear of most of the national opportunities in sports. Obama spent about $6 million with NBC on Olympic advertising. He also has been active for the baseball playoffs on TBS. But that’s been about it, network executives said.

“We’ve done basically nothing with the presidential campaigns,” said Seth Winter, NBC’s executive vice president of sales and marketing. “Most of the money is being poured locally into the swing states.”

Fox is telling a similar story.

“They keep calling us and asking,” said Neil Mulcahy, Fox Sports executive vice president of advertising sales. “But we haven’t seen a significant spend yet.”

One reason candidates have stayed away from national sports platforms is cost. A 60-second spot on “Sunday Night Football,” for example, costs more than $1 million, sources say. The campaigns can afford more ad time if they buy those same games locally.

Consider the way the campaigns approached the final “SNF” telecast of September, which featured the New York Giants against the Philadelphia Eagles, two teams from massive media markets, one in a state that is decidedly in the Obama column and the other in one that is mentioned as a swing state, but hasn’t attracted campaign ad dollars since the end of July.

The campaigns passed on a $1 million spot that would have bought them New York, Los Angeles, Chicago, Boston and Dallas — all markets that are of little significance to them. Instead, they focused on battlegrounds. Obama’s campaign bought “SNF” locally in Tampa and Jacksonville. Romney’s bought it in Charlotte, Miami and Milwaukee. Both bought in Orlando, Cleveland, Cincinnati and Columbus.

In Raleigh and West Palm Beach, both bought the less expensive “Football Night in America” pregame, which went for $1,000 and $900 per 30 seconds, respectively.

Obama bought two-minute spots in four markets and each campaign bought multiple spots in some markets, bringing the total spent on the game and the pregame in the four states to $376,400.

But, for a more appropriate comparison to the $1 million, 30-second national rate, consider that if one of the campaigns had purchased one spot in each of the nine battleground markets, it could have covered all that territory for $83,000. And that includes the $30,000 that Romney paid for his spot in Miami that night. The rest ranged from $3,500 in Jacksonville to $7,500 in Charlotte.

Political consultants say that reach is only one measure of a campaign’s media equation. Frequency is another. Campaign spots are more likely to begin to swing a voter if the voter has seen them five or six times.

In Tampa, the Republicans blanketed Olympic programming morning, noon and night.

Romney’s campaign bought three spots each day during weekday mornings and afternoons, paying $700 a spot. It bought four spots at $1,000 each morning the first weekend and two at $7,500 in the afternoon on the second weekend. It bought spots during the nightly, locally produced “Olympic Zone” show for $2,200 each.

With the Republican National Convention on the horizon, conservative-leaning PACs bought some of the most expensive real estate on television in Tampa-St. Petersburg, spending $459,900 in the 16 days of Olympic telecasts.

One spent $76,000 on three prime-time spots. Another bought a $33,000 spot on the opening ceremony and three prime-time spots at $20,000 each during the games. A third bought two $30,000 spots during the closing ceremony.

It was the planting of a flag in the market that was about to host the convention. Romney PACs spent five times more on Olympic programming in Tampa than they did in Orlando, 85 miles away. Their spend in Tampa nearly tripled the $165,400 they put into the other four Florida markets combined.

In contrast, the Obama campaign did not buy any spots on sports in Charlotte in the weeks leading up to the Democratic National Convention, held Sept. 4-6. Obama bought two $7,200 slots in the Carolina Panthers game Sept. 9, then ordered another in the Panthers game Oct. 7 for $7,500.

Charlotte is also one of the markets in which Obama bought deep into the baseball postseason, placing orders for a combined seven spots on three LCS games and also reserving two spots for $2,100 each on Game 6 of the World Series — if it’s necessary, and if he’s not pre-empted out of the slots.

That the Obama campaign was looking that far ahead, and buying baseball in a market without an MLB team, is an indication of the size and complexity of the operation buying its media.

“As with everything else when it comes to TV advertising placement and media buying strategy, Obama leads the way [in sports],” said Mark McKinnon, a political consultant who led the ad strategy for George W. Bush in 2000 and 2004. “They were on during NASCAR, they’re on during college ball, they were on last weekend during MLB. They even rolled out a new spot narrated by Morgan Freeman during baseball last weekend. Romney has been playing catch-up, is doing better lately but wasn’t anywhere for a long time.”

Cable joins in

ESPN figured the way to grab some of the local dollars was by going local. Earlier this year, it cut a deal with NCC, a cable operator group that acts as a middleman selling local ad spots for network and the advertisers.

That local push has been working for cable networks, where Obama has been outspending Romney as much as 10-to-1 on Fox Sports’ regional sports networks.

“Obama’s been on since May. Romney only came on recently,” said Stephen Ullman, regional vice president of partnership development for Home Team Sports, a division of Fox Sports. “Within college football it’s probably 2-to-1. But within baseball or overall spend in eight to 10 swing states, Obama’s spending substantially more.”

Since late May, Obama has had a heavy MLB schedule with FSN, which sells spots on non-Fox RSNs through Home Team Sports. His main focus was on swing states, with teams such as the Miami Marlins, Tampa Bay Rays and Washington Nationals. Romney stayed out of baseball, Ullman said.

Last month, Obama’s campaign started pouring money into college football, buying time on Big Ten Network, which serves the swing states of Iowa, Ohio and Pennsylvania.

“If you were to buy Ohio State football on an ABC affiliate in Columbus, Ohio, it would probably cost you through the nose just for that one market,” Ullman said. “The campaigns came to us to buy the Big Ten and they get the entire state and every DMA in the state of Ohio for relatively the same cost.”

In fact, the candidates have spent big on Ohio State football in Columbus. Obama bought on Buckeyes games on each weekend in September, paying $16,000 to $18,000 a spot on three of those dates and $32,000 on the fourth. He also has orders in on future games at $16,000 a spot.

Romney has bought college football in Columbus, but done it far less and opted for less expensive games, paying $1,000 to $3,000 a spot. Obama outspent Romney $180,800 to $28,000 on college games in the market.

Romney also has spent on college football on the RSNs.

“We see this in other categories, but it really happens here: It gets competitive,” said Sloan, of Home Team Sports. “One spends in a certain place and the other one will respond without us even needing to push it. As soon as Obama started in the college football, Romney followed suit.”

Ullman said FSN capitalized on Obama’s strategy to start spending on media early in the campaign, even before Romney officially won his party’s nomination.

Comcast’s RSNs are not seeing much presidential activity. But Comcast executive vice president Ray Warren said the networks are seeing more local political dollars this year, most focused on small races or ballot issues. Its CSN Northwest received its first political dollars this year around a local ballot initiative about same-sex marriages.

“We’re not getting that local [candidate] money,” Warren said. “We’re getting more issue money. Frankly, we are seeing a significant increase in revenue in this area.”

Two years ago, the trade association for local broadcast TV put out a research report to guide stations in attracting political spending. It broke out programming by segment, including sports. It found that golf viewers were more likely to be “somewhat conservative” and that college basketball fans were the most likely to be “somewhat liberal.”

The most likely place to find “middle of the road” viewers, who might be convinced to swing one way or the other? The NFL — which is precisely the place you will find the most sports spots in the swing states.

“When people watch sports, they’re not looking for politics,” Wilner said. “That’s one reason you advertise there. You might find the undecideds there. As much as people yell about how much has been spent on television in this campaign, the fact is that’s where the voters are. And they’re not coming looking for you. You have to push it to them.”