Bleacher Report has been one of the most polarizing destinations in online sports media, with its battery of user-generated content and liberal use of sexually suggestive slideshows sparking widespread industry debate over its relative merits.

But last week’s purchase of the 6-year-old portal by Turner Sports for an estimated $175 million was hailed as perhaps the most powerful testament to date of the fast-rising stature of independent digital sports media outlets.

The deal nearly doubled the record for the acquisition of any pure-play American online sports media outlet, the 2007 purchase of Rivals.com by Yahoo for $98 million. The Turner buy also was nearly six times the estimated $30 million USA Today Sports Media Group paid in January for the 70 percent of Big Lead Sports that it didn’t already own.

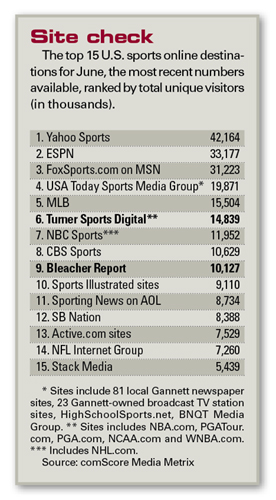

Those figures stand along Bleacher Report’s regular position among the top 12 U.S. sports sites in comScore traffic reports — its traffic typically exceeds 10 million unique users a month — and a revenue base projected to top $30 million this year. Together they represent a statement on the ability to create a competitive digital media outlet from scratch, or in this case an idea among four high school classmates, even as the content debates continue.

“This is really great for the entrepreneurial space that we operate in. It really validates what lot of people, including ourselves, have been doing to create new things and create value for both users and investors,” said David Katz, founder and chief executive of ThePostGame.com. “The Bleacher deal sends a really good signal to the space that big media believes entrepreneurial value is being created.”

Katz and ThePostGame.com, which operates in partnership with Yahoo, are nearing completion of a Series B venture capital round worth less than $5 million but drawing notable investors including former tennis stars Andre Agassi and wife Steffi Graf, and former Yahoo Chairman Terry Semel. But Katz and other independent digital sports media outlets said they aren’t necessarily chasing a big exit right on the heels of Turner’s acquisition.

“I’m very happy the market has responded by ascribing a strong asset value to something somewhat similar to what we do, but we still have very big aspirations to become the world’s leading digital media company,” said Jim Bankoff, chairman and chief executive of Vox Media, parent of SB Nation. “We’re still, quite frankly, in the early stages of building this company, and we’re still very long on Vox, as are our investors. We don’t see this as a musical chairs game at all.”

For Turner, the Bleacher Report acquisition provides a mainstream online sports property more focused on news content and not necessarily subject to swings of seasonality, as are the league and sport-specific sites it helps power such as NBA.com and NCAA.com. Turner did have such a property to present to advertisers when it ran the business operations of SI.com for about a year and a half. But once that relationship dissolved late last year amid a series of corporate culture clashes, Turner again had a hole in its portfolio.

“Having a 52-weeks-a-year platform was definitely important to us. In all candor, it was something we didn’t have,” said David Levy, Turner president of sales, distribution and sports. “This is a well-established brand, and we see a big opportunity to enhance our consumer experience and take what Bleacher Report already does well and expand significantly upon it.”

FAQ on the Bleacher Report deal

■ Will the Bleacher Report name disappear? No, the name, along with Bleacher’s San Francisco headquarters, will remain intact.

■ Will the top executives stay aboard? Yes. Chief Executive Brian Grey will take on an expanded role and report to Turner Sports Chief Operating Officer Lenny Daniels. Other Bleacher Report execs, such as Chief Revenue Officer Rich Calacci, will also assume bigger roles. “It was apparent early on in the discussions that our DNA and our cultures were very compatible,” Grey said.

■ What does this mean for digital competitors? The numbers will tell the tale, but by gaining Bleacher Report’s traffic, Turner Sports could soon grow beyond 25 million monthly unique users. That figure would typically be good for no worse than fourth behind Yahoo, ESPN and FoxSports.com in monthly comScore sports rankings.

— Eric Fisher

The company had planned to develop its own branded general-interest sports portal to launch in either late 2012 or early 2013, but those plans are now dead with Bleacher Report in hand.

Turner also intends to use Bleacher Report content and talent regularly across its television assets, including CNN and Headline News.

The Bleacher Report acquisition, roughly six times annual revenue, is high by online media standards. But Turner’s buy was also described by many industry observers as a technology buy as much as a media one, in which Bleacher Report’s publishing platform, which pushes out more than a thousand articles a day along a wide range of team affinities, was just as valuable as the eight-figure monthly audience the company attracts, if not more so.

“Once you get into technology platforms, it makes it a lot easier to justify any price,” said one digital media executive speaking on the condition of anonymity.

For Bleacher Report, the Turner acquisition extends a marked ascendency that in many ways began when Chief Executive Brian Grey joined the company in June 2010. Since then, Grey hired a new sales team and boosted advertising revenue significantly, helped close a $22 million round of venture capital funding, hired a team of experienced writers and editors to help boost editorial quality, launched a YouTube channel, and played a key role in shepherding the Turner deal to completion.

Bleacher Report has raised more than $40 million overall in funding, primarily from Silicon Valley venture capital firm Oak Investment Partners and more than any of its direct competitors.