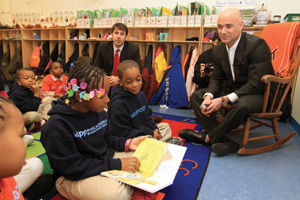

Andre Agassi sat at the front of a first-grade class at a recently opened Philadelphia charter school, asking as many questions as he answered. How are you going to make yourself better? How many of you think you are going to college? Where?

|

Andre Agassi talks to pupils at a new charter school in North Philadelphia.

All photos by: CANYON-AGASSI CHARTER SCHOOL FACILITIES FUND

|

When a teacher handed Agassi the book he was to read to the class, he held it out for the children gathered in front of him.

“Who’s going first?” he asked.

The morning’s selection was “Click, Clack, Moo,” a charming tale of a farmer whose cows demand improved living conditions. When the farmer rebukes them, they enlist the help of the hens, who join them in a strike that deprives him of his milk and eggs.

In the end, the ducks broker a compromise. The cows and hens get their electric blankets and the farmer gets his food.

It’s a story about standing up for yourself.

It’s also about the price we pay when we underestimate the potential of others.

Each child read a page, then passed the book along. Agassi watched. He nodded. He laughed.

Later in the morning, at a reception to celebrate the school’s first year in a building funded through an unprecedented investment fund that bears Agassi’s name, the retired tennis icon repeated what has become his gospel over the last decade, a belief that well-run charter schools — funded publicly but operated privately — are the best bet for turning around a flagging education system.

Agassi began down this path in 2001, with the opening of the Andre Agassi College Preparatory Academy, a charter school he built for about $40 million in a hardscrabble neighborhood in his hometown of Las Vegas. Initially opened to 150 children in grades 3 through 5, it since has grown to serve more than 1,000 students, K-12. Agassi Prep is tuition free, with the state providing about $6,400 per pupil and Agassi’s foundation adding $3 million to $4 million a year, according to its tax filings.

Then, last year, Agassi joined with Los Angeles-based Canyon Capital Realty Advisors to launch the Canyon-Agassi Charter School Facilities Fund, an investment vehicle designed to put traditional, for-profit capital to work building and rehabbing facilities for proven charter school operators. The fund attracted about $200 million from investors, including Intel, Citi and the Ewing Marion Kauffman Foundation, which when leveraged with bank loans will fund about $500 million in facility development, enough for about 70 more schools serving 30,000 students. If this round delivers as Canyon-Agassi hopes it will, the firm will consider a second fund targeting $1 billion, and then a third, Agassi said.

The first school built through the fund opened in August in North Philadelphia, operated in a converted warehouse by the Knowledge is Power Program. From the street, it looks more like a storefront than a school. But inside, it is bright and airy, with college pennants lining the hallways and inspirational quotations stenciled on the walls.

One from Walt Disney promises that “All our dreams can come true if we have the courage to pursue them.” Next to it is one from Agassi: “Nothing can substitute for just hard work.”

“Give them the tools, and you’ll find first-graders who read like third-graders,” Agassi said as he left the classroom. “Fail them, and they’ll still be at a first-grade level when they reach third grade.

“All across this country, we’re failing these children. And the cost is staggering.

“We’re failing our future.”

■ ■ ■

On a Friday morning at Agassi Prep early last month, the school’s founder walked the eight-acre campus, poking his head into the gym to check on preparations for the next day’s graduation ceremony. It was here, in a similar setting two years ago, that Nevada gubernatorial candidates vigorously debated education proposals.

With 11 years as a school operator under his belt, Agassi is quick to offer a few proposals of his own. He believes the school day should be longer. And that summer vacation should be shorter. More than anything, he believes a school should not only educate, but inspire.

On a tour he has led dozens of times for prospective donors, Agassi showed off a vast, well-equipped art studio, a music room fit for a symphony and a fully wired television studio, complete with green screen.

|

Education allows you to choose your path, Agassi says, something he wants for all children.

|

Standing at the high school, looking back to the elementary school building at the front of campus, Agassi pointed out a three-story-high, 100-foot-long bridge. It is used only once a year, when Agassi Prep graduates cross it during commencement. For all the amenities that he built into the campus, it is this sort of thing — a bridge, or a simple, symbolic tree at the center of a courtyard — that most captivates Agassi.

“The vision I had wasn’t about the bricks and mortar,” Agassi said. “The vision I had was [of] a place where kids aren’t doing what I did in school — looking forward to running to the car when it was over with. Running to recess. I pictured kids finding that learning was actually enjoyable.”

That, Agassi has found, has more to do with the people than the place. The school endured its share of growing pains through its first decade, taking criticism for high teacher turnover and for not accepting enough students from nearby low-income neighborhoods. Agassi feared it was delivering less than he promised. He said he has made important changes since becoming more engaged in the last few years. The elementary school has been designated “high achieving” under federal standards. All of the high school’s graduates have been accepted into college.

Still, you cannot start a school without a suitable structure, and it is there that even the best charter operators find their greatest impediment. While charter schools are publicly funded, per-pupil allocations are based only on operating expenses. Startup schools are responsible for funding their own hard costs, such as rent or construction. As a result, charters frequently open in unlikely locations that come cheaply — church basements, Boys and Girls Clubs, and strip shopping centers that have fallen out of favor.

Those who take the plunge to build something more suitable must fundraise to pay for it. A decade in, Agassi still sweated under the heat of a $40 million mortgage.

The chairman of Canyon Capital Realty Advisors, Bobby Turner, was well aware of the financial pressures facing charter operators when he approached Agassi last year with an idea that could change that dynamic.

For six years, Turner has served on the board of a California-based nonprofit, Pacific Charter School Development, which has used about $40 million in contributions from the foundations of Eli Broad, Bill Gates and the Walton family to fund the construction of charter schools in Southern California. The nonprofit pays for construction or renovation, gives the school time to stabilize financially, then floats tax-exempt bonds that allow the operator to purchase the facility at cost. PCSD then recycles the money from the sale to build more schools.

The group has built schools for 38 charter operators serving 16,000 students. Yet the waiting list in the region is more than twice that.

“We built all those schools, and I was the most depressed guy in the world,” Turner said. “All I could think of was all the kids we failed to reach.”

Inspired by the PCSD model but convinced that demand would outpace its means, Turner went to work on a new approach. He knew there was an appetite for charter schools. He also knew there was a glut of the sort of low- or no-cost properties that would be ideal for such schools — large, unused or underused buildings, many of them in the very neighborhoods of the children who populated the wait lists. And he knew that charter operators would qualify for tax breaks and attractive financing terms once they had their feet steadied and were ready to buy.

|

Agassi (left), with a $40 million mortgage at his Las Vegas charter school, joined forces with Canyon Capital Realty Advisors’ Bobby Turner.

|

Turner saw the opportunity to acquire distressed properties, turn them into charter schools and lease and then sell them to operators — all while throwing off a profit. He could create a real estate fund that could meet a societal need while offering investors market-rate returns.

A decade earlier at Canyon, he had forged a joint venture with Magic Johnson that put for-profit capital to work in inner-city neighborhoods. Turner approached Johnson on that project because Johnson understood the community’s needs and could help gain the trust of its leaders. He was both prominent and respected.

Canyon’s first fund with Johnson raised $300 million in capital. Its second raised $600 million. Its third is at $1 billion, and counting.

The investment firm’s pairing with Agassi had a bit of kismet to it. Canyon’s offices are in the same Century City building as the headquarters of CAA, which represents both Agassi and his wife, Steffi Graf. It was Steve Heumann, head of CAA’s tennis practice, who sent Turner a copy of Agassi’s best-selling book “One,” thinking the two might find a way to work together once they knew they shared a passion.

Turner believed that for Canyon to create a vehicle similar to its urban fund around charter schools, he would need another champion. After reading “One,” he came away convinced Agassi would be ideal.

“There’s always a gap of arrogance and trust when you take for-profit capital into a market that has been deemed only worthy of philanthropy and government spending,” Turner said. “Andre bridges that gap. He’s the perfect ambassador of great will in the area of education.

“If it’s me, I’m just a big money manager coming in to make money off the kids. ButAndre has fought this battle for 13 years, with the same passion for education and same frustration with government that many of us have. He’s a guy who has lived the educational quagmire. He has a voice that is trusted.”

Turner decided to approach Agassi with the idea for the fund.

For the first 45 minutes of his pitch, Turner explained the depth and scope of the problem:That U.S. students were slipping further behind those in other countries on standardized test scores; that more than 1 million drop out of school each year. He suggested that sufficiently funded, well-run charter schools, such as Agassi’s, could help stem that problem, if only more of them could afford facilities to house their programs.

“It was one of the most fascinating hour-and-a-half meetings I’ve taken, but the first 45 minutes was everything I already knew,” Agassi said. “I lived with a $40 millionmortgage over my head, trying to get sleep. Believe me, Ambien is no match for a $40 million mortgage. You still wake up in the middle of the night, wondering how you’re going to pull this off.

“He was describing the water I’m drowning in.”

Then, Turner told Agassi something he hadn’t heard, or lived. He explained the way PCSD had funded schools in Southern California.They discussed how, while successful, PCSD’s philanthropic model wasn’t sustainable, or scalable. Agassi considered that against his own experience.

He has seen himself as a philanthropist for his entire adult life. He provides clothing for about 6,000 children a year. He funds a shelter for abused children and a Boys and Girls Club that provides after-school programs.

Yet the more he did, the more he found that still needed to be done.

“I realized I was sticking Band-Aids on real issues,” Agassi said. “The only way to solve real systemic problems and make systemic change is to educate.”

Now entering its second decade, Agassi Prep has grown steadily. But so has the waiting list.

And so have the financial pressures facing its operator. Agassi says that, were it not for an $18 million donation from Las Vegas resort magnate Kirk Kerkorian last year, he doubts he would have been able to guarantee the school’s funding into perpetuity.

“I’m proud of what we’ve been able to do here,” Agassi said, laying out the ways in which the school has met its many challenges. “But it doesn’t scale. Philanthropy ends when

philanthropists run out of money. I’m pretty dogmatic about that at this stage.”

As Agassi digested Turner’s proposal that he put his name and his energy behind the fund and some of his own money into it, it resonated with him. The hurdle for Agassi was the somewhat uncomfortable shift from philanthropist to social-impact capitalist. The Canyon-Agassi fund has two purposes. One is to fund facilities for schools. The other is to return a profit.

“One of the first things we talked about was what we would say when people say you’re making money off these kids,” said Steve Miller, a longtime sports industry executive who has served as CEO of Agassi’s foundation since 2008 and Agassi-Graf Holdings since 2009. “He didn’t want to ruin what he has been doing all these years by someone misunderstanding his goals and objectives.

“It took a while, but we came to grips with it.

The other way is not working. Philanthropy is great. It’s fantastic. But we’ve got an educational problem. And whatever we’re doing, it’s taking us in the wrong direction. Charter schools are not the answer. But they’re part of it.”

Agassi said he let the idea marinate for about two months before opting in.

“It came down to one simple question, really,” Agassi said. “What’s the alternative? If the alternative is unconscionable, then it’s something I have to do.”

■ ■ ■

As it became clear that he was in the final set of his tennis career, Agassi told those closest to him that he would never choose to retire.

Instead, he would wait for retirement to choose him.

Though Agassi hated the sport at one point in his life, resenting it for taking so much time and energy during his youth, he came to grips with that loss, choosing instead to focus on what it had given him.

Tennis was the platform from which he could do so much. Help so many.

He was not about to go gently away from that.

And so Agassi played and played and played until finally, six years ago, his body could weather no more. He was not finished, but he was ready to do something different, or at least differently.

“I saw retirement as a swim to Hawaii,” Agassi said. “I’m never going to get there, but I can enjoy the entire thing. There’s nothing I have to do. There’s no destination. That resonates so strongly with me.

“I knew I was going to be happy and be focused and find meaning. I knew that I was going to find a job. And I knew people were going to be better as a result of it, because I wouldn’t choose to do it otherwise.”

Agassi’s first move was to shift his attention to his foundation, and especially the school, which had always been a passion but now would become his focus. What he found troubled him. Six years ago, Agassi Prep’s endowment had an investment portfolio of about $50 million. Its mortgage was $40 million. They were spending about $6 million a year before paying down any loans.

“It was a dead-end street, and the wall was coming quickly,” Agassi said. “I was going to eventually have to take this school away from these kids because it was going to run itself into the ground.”

Agassi went to work restructuring. To run the foundation, he brought in Miller, who had been on the board since its inception. Miller cut administrative expenses, instituted greater transparency and more controls, and moved investments out of speculative hedge funds and into low-risk bonds.

Today, the school’s endowment has eclipsed $95 million and the mortgage is down to about $18 million, Agassi said. He hesitates to use the word “perpetuity,” because he fears donors will take that to mean the school no longer requires their support, but he is confident it will remain financially stable into the distant future.

Looking out a conference room onto a courtyard filled with elementary school children playing during recess, Agassi explained that this is what he wanted from life, and particularly from tennis.

He traced it back to “an epiphany” he had in 1997. That year marked the nadir of Agassi’s tennis career. He fell to No. 141 in the rankings. He also tested positive for methamphetamines.

After he was eliminated in the first round of an ATP Masters Series event in Stuttgart, Germany, Agassi sat in his hotel room, angry and depressed. Staring out the window, he watched people going about their daily lives.

“Where are they going right now?” he wondered. “Is it something they chose? Or have they found their reason for that life?

“I committed at that moment to find a reason for this. A reason for my life. A reason to play tennis. That’s where the inspiration for the school came from. That’s when I started to leverage my fame and fortune and relationships and resources. That’s why I wanted to make a difference in these kids lives on such a committed level. Because by becoming my reason, they saved my life.”

It is interesting that Agassi chose education as the core of his commitment. He left Las Vegas to train at Nick Bollettieri’s tennis academy in Bradenton, Fla., when he was 13, then dropped out of school three years later, when he was still in ninth grade.

Over the years, he came to appreciate tennis for the wealth and the opportunities that it brought him. But it also took things from him. He never felt he had a choice in what he would do with his life. He lost out on traditional schooling.

It turned out well for Agassi. But he knows it would not for most.

“I found myself in this life,” Agassi said. “And it always registered with me that if you don’t have an education, you will find yourself in a life. These kids, where they find themselves, will be much worse than being a world-class athlete with millions of dollars. You’re going to be in the streets. In jail. In hospitals. In the morgue. That’s the reality of these kids’ lives if they don’t get an education.

“There is a correlation between my experience and what I’m trying to do here. I didn’t have an education. I found myself in a life I didn’t choose. I got lucky. If these kids don’t get an education, they will find themselves in a life they don’t choose.

“And it’s not going to be so lucky.”