“Suppose a fellow is very hard up. Say I have a ticket to sell. It is worth $20. I will sell it for $10. Should the government intervene on behalf of the individual and say, ‘You shall not discount it for more than 10 percent’?”

— Sen. Stephen Elkins, member of the Senate Committee on Interstate Commerce

“There is not a ticket scalper in the United States who will appear before you and tell one truth or two truths or any truth in regard to it. Their whole business is founded upon lying and thievery and counterfeiting and everything that is wicked.”

— George H. Daniels, a ticketing executive testifying before the Senate Committee on Interstate Commerce

On a Thursday morning in December, a Senate committee convened hearings to address an issue that had percolated for the better part of three decades: the resale of tickets by unregulated brokers, who secured scores of seats and resold them at market price, a practice long known as “scalping.”

Ticket issuers testified that the free-flowing resale market undermined their pricing. Brokers who received discounts for buying in bulk often resold the tickets at less than face price, yet still turned a profit. Consumers complained that tickets didn’t always come as advertised. Some were counterfeit. Buyers were without recourse.

Brokers countered that they worked in concert with the original sellers, shouldering a risk by buying large blocks of tickets that might otherwise go unsold. They argued that they frequently offered consumers the benefit of lower prices, and that they shouldn’t be lumped in with unscrupulous scalpers who forged tickets and harassed people as they walked to their gates. They charged that while the ticket issuers publicly lobbied Congress for intervention, many continued to sell brokers large swaths of seats.

So charged was the discussion at times that a man testifying passionately against ticket brokers suggested that legislators place “the brand of infamy upon this contemptible business for all time to come by placing such institution in the same category with houses of prostitution, which is exactly where they should belong.”

It was 1897, and they were talking about railroad tickets.

• • • • •

The initial sale of a ticket is a simple transaction, whether it’s a ticket to ride the train or watch the Jets. Someone pays someone else to get on, or get in.

It’s when that ticket changes hands again that things can get more complicated. And confrontational.

In the last five years, state legislatures across the country have taken a closer look at what has unfolded since many of them relaxed decades-old laws that prohibited, or restricted, ticket scalping — which since the emergence of the Web and various online ticket exchanges is more politely termed “ticket resale.”

Legislators in five states — Florida, New Jersey, Minnesota, Massachusetts and Tennessee — have introduced or reintroduced ticket-related bills this year (see story, Page 16). New York state renewed its ban on forced paperless ticketing in May. Last year, state legislators introduced ticket-related bills in Connecticut, North Carolina and Arkansas.

Two congressmen — Rep. Jim Matheson (D-Utah) and Rep. Lee Terry (R-Nebraska) — introduced their latest version of “The Ticket Act,” which would strike down the few remaining state anti-scalping laws and keep ticketing companies and teams from restricting resale channels.

Publicly, during rallies, at hearings and in e-blasts, it plays out as consumers versus big business. But sweep the rhetoric aside and it is more a battle between big businesses: Ticketing companies, sports franchises, artists and venues against eBay and the large ticket brokers who traffic in hundreds of millions worth of seats each year.

Mostly, it is Ticketmaster and its parent company, Live Nation, versus StubHub and its parent, eBay.

At stake is control over the secondary market for tickets to concerts and sporting events, estimated to be worth upward of $4 billion annually in the U.S.

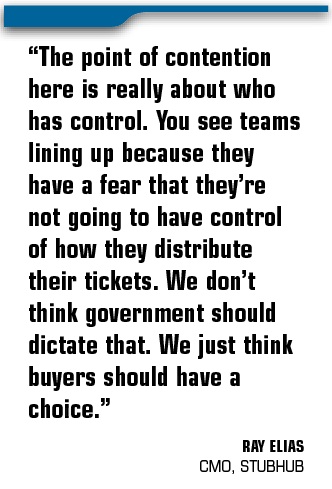

“The point of contention here is really about who has control,” said Ray Elias, chief marketing officer of StubHub, the ticket resale site that lobbied hard to get scalping laws abolished and now is pushing legislation that protects unfettered resale. “You see teams lining up because they have a fear that they’re not going to have control of how they distribute their tickets. We don’t think government should dictate that. We just think buyers should have a choice.”

Ticketmaster has charged aggressively into the secondary market through its Tickets Now and Ticket Exchange sites, offering clients who sold the original tickets the opportunity to share in the commissions and fees from resales and in the consumer data generated by the transactions.

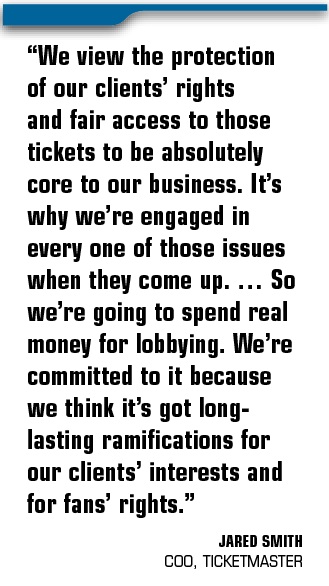

“We view this as a seminal issue,” said Jared Smith, chief operating officer of Ticketmaster. “We view the protection of our clients’ rights and fair access to those tickets to be absolutely core to our business. It’s why we’re engaged in every one of those issues when they come up. It’s why we advise clients and form coalitions. We’re the one constant that moves from state to state. So we’re going to spend real money for lobbying. We’re committed to it because we think it’s got long-lasting ramifications for our clients’ interests and for fans’ rights.”

While its motivation — business preservation — is similar to Ticketmaster’s, StubHub has wrapped its arguments in the protection of consumers. Those have resonated with some lawmakers.

|

The illustration for this book in 1900 gives an unflattering portrayal of how a theater manager gets higher prices for tickets.

Photo by: Library of Congress |

That’s what happened at the turn of the 20th Century, when Congress looked into ticket-scalping practices that plagued interstate railroad travel, as it became increasingly common for brokers to buy and sell the unused legs of long-distance train tickets, often encouraging fraud in the process.

It happened again in the 1920s, when New York state capped resale prices in response to scalpers clustered outside Broadway theaters. The U.S. Supreme Court soon struck that law down, but it gained a second life in the ’60s when a federal court ruled that anti-scalping laws could serve the public interest. Many states enacted them.

Then, a decade ago, the ticket resale tides turned.

The Internet turned anyone with a mouse and a credit card into a ticket broker. The ability to buy Springsteen tickets from a desk in New Mexico, New Hampshire or New Delhi and sell them to someone in New York made jurisdictional folly of state laws. As the resale market moved from stadium parking lots and arena steps to the seeming safety of the Web, consumers became more comfortable with buying on what has become known as the “secondary market.”

Just as scalping laws arose when consumers felt they’d been stung by brokers, they fell when those same people saw an opportunity to make money off others.

The debate is no longer about whether people should be able to resell tickets, but how. As it plays out in state houses across the country, StubHub and Ticketmaster are there, spending tens of thousands per year, per state, on lobbyists to carry their message. StubHub’s lobby often goes in flanked by consumer groups and free-market advocates. Ticketmaster brings representatives from the local teams and venues and music community.

And the fight is on.

“You can add up every lobbyist ever hired by eBay … (and) they don’t compare to the local power of the sports team, the venues, the theaters, the concert promoters,” said Jon Potter, founder and president of the Fan Freedom Project, a nonprofit activist group that receives much of its funding from eBay. “If the consumer arguments here weren’t so powerful, these bills would never see the light of day. But the property rights, the consumer rights and the free-market rights are so powerful that they get to hearings and get bills introduced and get people fired up.”

• • • • •

When Jim Battin was a California state senator, he and his staff decided they wanted to go as a group to see the Eagles in concert. On the morning of the Ticketmaster on-sale date, they gathered in the office and sat down at their computers, figuring more people banging for tickets would give them a better chance to win the race for the best seats.

The show sold out in less than a minute. Battin and his staff were shut out.

Frustrated, Battin made a few phone calls to find out how this could happen. He was told that scalpers who once paid students to jam the lines for tickets at record stores now employed more sophisticated techniques, using computer software to lock up the best seats and making it difficult for fans to secure seats at face price.

The next morning Battin went to work on what he filed as a simple, four-paragraph bill that would have addressed the problem at its base, making it illegal to re-sell a ticket for more than 10 percent over cost and banning concert promoters and venues from purposely funneling tickets to brokers.

“That’s where we got started,” said Battin, a Republican who served in the California Senate and Assembly for 14 years. “And then all the forces in the world converged on us, led by eBay, because eBay makes a lot of money on tickets.

“This was out of the ordinary. I did all the Indian gaming stuff, where the money is huge. So I know what it’s like when everything converges. But this, to me, was unexpected. I guess I hadn’t thought through the amount of money that it was affecting.”

A review of lobbying expenditures and campaign contributions in the states in which ticket legislation has percolated reveals that what Battin experienced was the norm.

EBay spent $1.6 million lobbying Congress and the federal government on a range of legislation and regulation in 2011. Eight different firms hired by eBay reported lobbying in support of HR 950, “The Ticket Act,” which for the last year has laid dormant in a House subcommittee.

Live Nation reported spending $55,000 on federal lobbying in 2011, all of it lobbying against HR 950. Lobbyists representing Major League Baseball also opposed the bill.

This debate has played out far more actively in the state capitols than within the Beltway. Mostly, the discussion has involved concert tickets.

Paperless tickets — the kind that require a buyer to show ID and swipe a credit card in order to enter the gate — were

created to box out brokers and improve access for fans who would rather sit in their seats than turn a profit on them.

Other than a handful of sports franchises that have introduced them in limited circumstances — the Boston Red Sox offer discounted family packs that can’t be flipped, for example — paperless tickets primarily have remained the domain of music acts. Bruce Springsteen has gone paperless for some seats. So have teen favorites Miley Cyrus and Justin Bieber.

New York banned forced, non-transferable paperless ticketing “temporarily” in 2010 and has renewed the prohibition each year since then. Florida, New Jersey, Minnesota and Massachusetts considered prohibiting it this year, though none of the bills have passed.

The other common piece of recent bills, transparency, also targets the concert business. That legislation requires ticket issuers to reveal how many tickets they will sell in each price range and how many will be made available only through pre-sales or held back from the initial public sale.

StubHub and other proponents of transparency legislation say it is meant to keep promoters and Ticketmaster honest, letting fans know whether they’ve got a realistic shot at a seat. Ticketmaster says it is meant to give brokers a road map for how to lock up tickets and price them.

While bills addressing paperless technology and transparency have their roots in the uproar that comes when fans are boxed out from seeing The Biebs or The Boss, they affect all who sell tickets, including sports franchises and venues. Ticketmaster has beat a steady drum urging involvement by its sports clients.

“Once they understand what is going on they become instantly engaged because they understand the ramifications,” Smith said. “I think it’s a serious issue for the teams. … Whether you’re talking about Madonna or the Seahawks or the Braves, they have a right to have a direct relationship with the fan. It’s central to the long-term health of their business. So sports teams — the hair on the back of their neck stands up when someone challenges their ability to relate directly to their fans.”

Just as Smith is quick to point out that eBay’s interest lies not in the fans, but in what they bring to its balance sheets, Potter says that when teams talk about relating directly to fans, they mean control.

“This is about how do we own the secondary market,” Potter said. “How do we get another transaction fee? How do we put in price floors? And how do we eliminate competition?”

• • • • •

While separating StubHub from eBay’s broader lobbying interests can be difficult, the company’s activities in Florida in recent years are revealing.

In the first quarter of this year, eBay spent $30,000 to $40,000 with Florida lobbying firm Capital City Consulting. It was Capital City co-founder Nick Iarossi who represented StubHub in its push to get scalping laws rescinded in Florida in 2006. Iarossi lobbied on behalf of StubHub through 2007, but it hadn’t used him since then.

That first quarter 2012 surge, which coincided with ticket-related bills in both sides of the statehouse, represented at least three times what eBay spent in any quarter of 2011 in Florida. While always active in the state, the company typically spends less than $10,000 per quarter.

|

The Fan Freedom Project is an activist group that receives much of its funding from eBay.

|

Equally revealing was spending by the company’s political action committee (PAC), which made two campaign contributions of $500 each in Florida during the most recent filing period. One was to Sen. Ellyn Bogdanoff, the other to Sen. Don Gaetz. Bogdanoff authored the Senate version of Florida’s ticketing bill. The House bill was sponsored by Rep. Matt Gaetz, who is Don Gaetz’s son.

They were the first campaign contributions the company made in Florida since 2006, when it gave $5,000 to the state Republican party and $2,500 to the state Democratic party and $500 each to two candidates.

StubHub would not comment on its governmental strategy. But its PAC clearly is keeping watch over which state legislators — and federal lawmakers — have carried the water on its issues.

Last year, it contributed in only three states outside California: Virginia, Utah and New Jersey. Its two New Jersey contributions went to Sen. Ray Lesniak, who co-authored a comprehensive anti-paperless bill, and Sen. Nia Gill, the chair of the commerce committee.

It also contributed to both sponsors of the one piece of active federal legislation addressing tickets.

Terry, the Nebraska Republican who co-sponsored the bill in the U.S. House, received $4,250 from eBay this cycle — the most the company gave to any of the 43 House campaigns to which it contributed. Matheson, the Utah Democrat who was the other sponsor, received $2,500 from eBay — more than it gave to all but eight representatives. Neither chairs a committee, but as members of the commerce committee, both are engaged in legislation affecting eBay’s broader business, including the controversial Stop Online Piracy Act (SOPA), which Terry co-sponsored and then withdrew from and Matheson has vocally opposed.

Since 2006, eBay has contributed $89,450 to the campaigns of elected officials in 15 states, not counting California.

While Live Nation does not contribute to campaigns, state lobbying records show the firm slugging it out with eBay on even footing in what looks a lot like a game of Whac-A-Mole, with StubHub lobbyists pushing to get bills introduced and Ticketmaster working to squash them.

Live Nation reported lobbying in only eight states in the last 18 months. Seven were considering legislation that would place tight restrictions on paperless technology and/or require transparency, including detailed disclosure of ticket inventory. The other, Tennessee, was studying a bill that Ticketmaster supported that could have carved out the resale market for the original ticket issuers — the teams, promoters and ticketing companies.

A pair of hearings on a bill that would have restricted paperless ticketing in Minnesota provided a snapshot of how the forces align on each side, although more often than not it’s behind the scenes. StubHub’s government relations head, Dusty Brighton, testified in support of the bill, as did Potter and other consumer advocates. Testimony in opposition came from representatives of the Twins, Vikings, Timberwolves and Wild, as well as Xcel Energy Center.

“For years, we’ve been trying to keep markets open,” Elias said. “This is America. I don’t really understand why tickets are different from any other property. That’s just our belief.”

Turnkey Sports Poll

The following are results of the Turnkey Sports Poll taken in May. The survey covered more than 1,100 senior-level sports industry executives spanning professional and college sports.

Should there be federal legislation regulating the secondary ticketing market in sports and live entertainment? Should there be federal legislation regulating the secondary ticketing market in sports and live entertainment? |

| Yes | 29% |

| No | 64% |

| Not sure / No response | 7% |

| |

Moving forward, do you expect properties to have more direct influence on the business practices of their official secondary ticketing partners? Moving forward, do you expect properties to have more direct influence on the business practices of their official secondary ticketing partners? |

| Yes | 89% |

| No | 8% |

| Not sure / No response | 3% |

| |

Which of the following is the driving force behind properties wanting to have more control of the secondary ticketing market? Which of the following is the driving force behind properties wanting to have more control of the secondary ticketing market? |

| Access to additional revenue streams | 39% |

| Protecting the value of season tickets | 35% |

| Growth of data collection and fan tracking opportunities | 18% |

| Concern over authenticity of tickets | 6% |

| Ease of purchase for end user | 1% |

| Not sure / No response | 1% |

Source: Turnkey Sports & Entertainment in conjunction with SportsBusiness Journal. Turnkey Intelligence specializes in research, measurement and lead generation for brands and properties. Visit www.turnkeyse.com.

The Minnesota bill passed the House and made it through a Senate committee, but then died when it failed to reach the floor before the legislature adjourned.

“They wrap themselves in consumerism because it’s effective, not because it’s true,” Smith said. “This is about protecting their ability to make money off fans, not about protecting fans. The good news is even though that gets them on the radar in a bunch of states, once those same legislators are educated by teams and managers and promoters, they typically change their minds.

“How many bills have passed? We are pretty effective at dispelling almost everything they say.”

Battin, the California legislator who unexpectedly found himself in the crosshairs of both eBay and Live Nation back in 2005, no longer gets calls from either of them. He left office in 2008. But he still has strong opinions on the issue.

On both sides.

The free-market proponent in him respects the fact that brokers take a risk on tickets and believes they deserve some reward. And he thinks season-ticket holders should be able to finance their purchase by reselling some seats. But he thinks the software that brokers use gives them an unfair advantage and should be illegal. And he was as frustrated as anyone when tickets to see his Oregon Ducks play for the BCS championship were going for $1,600.

“When you really get into it, there’s a lot to it on both sides,” Battin said. “I learned all about the world of ticket brokers and Ticketmaster and eBay.

“I had them all in my office.”