Early into a Friday night game at Turner Field in Atlanta at the end of July, an in-house TV spot took over a center-field video screen the size of Iowa, reminding fans to head to Braves.com for all their essentials: To get a second look at a diving catch, replace an old ballcap or secure seats for an upcoming game.

An inning later, a disembodied voice boomed throughout the ballpark, threatening to shake loose thousands of empty seats upstairs.

STUUUUUUUUB … HUUUUUUUUB!

Derek Schiller listened to that booming voice night after night this season. And then, morning after morning, the Braves’ ranking sales and marketing executive scrolled through the sales reports that lit up his computer screen.

In the five days leading up to that game in July, 547 sellers moved 2,004 tickets for $48,801 on StubHub. Nine out of 10 tickets cost less than they would have at Braves.com.

Yet almost half those tickets (45 percent) fetched more than the sellers paid for them if they were bought as season tickets — a near certainty, considering 92 percent of the baseball tickets sold on StubHub come from season accounts.

Ninety percent of the buyers got a deal, half the sellers charged more than they paid, a quarter of them made money and the Braves were left with about 20,000 unsold seats.

|

GETTY IMAGES

StubHub’s deal with MLBAM served as a template for the company to sign other partnerships in sports. |

The upside of MLB Advanced Media’s hand-in-glove relationship with the Wal-Mart of online resellers is a large check it receives each year. StubHub sends more than half of the fees and commissions it collects on its baseball sales back to MLBAM, which then kicks some back to the teams. It also sponsors the league and 22 teams. Those payments to MLBAM and the teams will approach $60 million this year, according to sources familiar with the deal.

The downside is that the partnership has changed the ticket market in ways that most teams are only beginning to understand, and that some fear could compromise their business at its foundation if they don’t make changes soon. Increasingly, buyers are bypassing the teams and heading directly to StubHub. Some teams say the wide selection of good seats to all games has cost them season-ticket holders.

Last year, pressured by clubs that endured a frosty renewal season, including the previously StubHub-friendly New

York Yankees, MLB Commissioner Bud Selig empaneled a group of executives from the league and six teams, including the Braves, to explore the rapidly changing nature of ticket sales. At the top of their list is the StubHub deal, which expires at the end of next year.

“I don’t believe there is any bigger obstacle or issue, any bigger threat to the professional team sports marketplace and industry as a whole, than what you guys are looking into,” Schiller said when told of a SportsBusiness Journal project that tracked more than 7,000 StubHub transactions for MLB games played on the first Friday in August. “This is the single biggest issue facing our industry.

“The amount of dollars at risk is growing near exponentially. And we absolutely as an industry — and not just baseball — need to manage it.”

This season, almost 8 million MLB tickets sold on StubHub, according to industry sources. That was an increase of almost 2 million over last year. StubHub sales rose for at least 25 of 30 teams. While the gap between the busiest and slowest sellers was vast, on average MLB clubs watched about 3,000 tickets per game, or about 10 percent of their average gate of 30,000, move on StubHub.

While he would not reveal a specific number, Schiller confirmed that the Braves were close to the average. The club also saw an almost identical decline in single game sales.

Schiller says the data deserves more study. He understands that every ticket that resold was, in fact, sold in the first place by the Braves, and that was a plus. So was the share the Braves received from the StubHub sale. Each ticket throws off $5.20 in fees and 20 to 25 percent in commissions, and baseball gets about half of that take. Still, Schiller can’t help connecting the dots between those that sold twice and those that didn’t sell at all.

And it troubles him.

Once thought of as a place where fans could pay a premium for great seats at hard-to-crack events, the secondary market has revealed itself to be something far more worrisome to many teams: a flea market where buyers have their pick from thousands of seats to many games, often at prices that compete with, or even beat, the prices offered by the teams.

The handful of teams in baseball, the NHL and NBA that play mostly to sold-out houses see their ticket prices hold firm on the resale market. But for many games on many nights, StubHub is the place fans go to score a deal.

“It’s a dumping ground,” said Ticketmaster CEO Nathan Hubbard, whose company has battled StubHub fiercely in the public forum. “The scalpers are still making their money. They’re buying season tickets, making their money off the Yankees game and dumping everything else. Good for the scalpers and good for Stub. But it’s killing the teams.”

Not everyone sees it that way.

For a few MLB teams, such as the Boston Red Sox and San Francisco Giants, StubHub offers a chance to continue to make money from ticket sales, even after most of their seats have been sold. The Giants, who played to 99.8 percent capacity this season, saw about 11,000 tickets per game resell on StubHub.

“StubHub has been a great partner and we’ve embraced them,” said Russ Stanley, managing vice president of ticket sales and services for the Giants. “Our StubHub numbers grow every year in amazing ways. I’m proud of that.

“The secondary market is like anything else. You can benefit from it or you can get hurt by it. I understand that it hurts when you see your tickets out there for $2 for a particular game. It’s absolutely painful. It’s bad for the brand. Nobody wants to see that. But you can’t close your eyes to it. You have to work to understand it and you have to adapt to it. You really don’t have any choice, because the secondary market is here and it’s not going away.”

That long has been the mantra of one of the deal’s chief architects, MLBAM Chief Executive Bob Bowman. The secondary market was coming like a freight train whether MLB welcomed it or not, and StubHub was at the front of it. Better to ride on that train than under it. Painted as a StubHub defender by the clubs, Bowman says it’s time for the industry to consider whether the path it chose five years ago is right for it today.

The good news, Bowman said, is that the mountain of data that MLBAM has compiled in its five years with StubHub gives the league a far clearer picture of how the ticket market works than it would have if it kept StubHub at arm’s length. He long has argued that the greatest value in that deal was in the data, not the dollars. Now he gets the chance to prove it.

“It’s not just price and supply and who runs it,” Bowman said. “It’s those issues plus 30 more all interacting at the same time. Trying to wrestle this to the ground is not easy.”

A tale of two markets

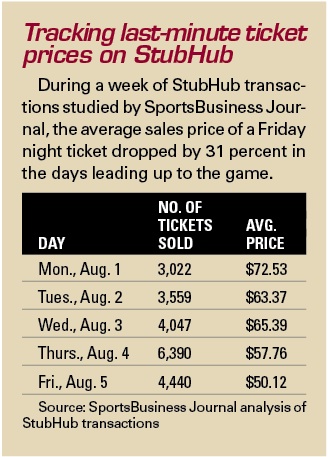

To better understand the resale market for baseball tickets, SportsBusiness Journal logged and analyzed all StubHub sales — not listings, but tickets sold — in the five days leading up to the 15 games played on the first Friday in August.

From Monday morning up until three hours before game time, sellers moved 21,466 tickets in 7,384 transactions worth $1,229,500, including fees. Nine games exceeded 1,000 tickets sold, with six of those eclipsing 1,900. Five games broke $100,000. Forty-four percent of tickets sold for less than the single-game face price.

It was one day out of 162, and captured only sales made in the final five days. A snapshot, not an MRI.

Still, based on conversations with senior executives from teams and ticketing companies, many of the revelations gleaned from that snapshot reflect the broader problems they face.

Prominent among them: There are two StubHubs.

On that week, there was the StubHub of the Giants, Red Sox, Chicago Cubs, Minnesota Twins and Pittsburgh Pirates,

|

GETTY IMAGES

Teams whose tickets are in high demand, such as the Giants, are more likely to embrace the league’s StubHub partnership. |

where more than 90 percent of tickets sold for more than their face price. Tickets for the rematch of the Giants’ National League Championship Series against the Philadelphia Phillies brought an average profit of 90 percent. Tickets for the Yankees’ visit to Fenway Park went for more than three times over face.

And then there was the StubHub of the other two-thirds of the teams — the Los Angeles Angels, Houston Astros, Baltimore Orioles, Arizona Diamondbacks, Florida Marlins, New York Mets, Texas Rangers, Tampa Bay Rays, Colorado Rockies and Kansas City Royals — each of which saw upward of 69 percent of their tickets sell for less than the face price. More than 80 percent of tickets were under face for six of those 10 games.

The Angels were a game out of first place at the time. The Diamondbacks were on their way to winning the NL West. The Rangers would make the World Series. The Mets were hosting the Braves.

It was the first weekend in August. Kids were out of school. Rain wasn’t a factor anywhere. And yet scores of tickets flipped on StubHub at a discount.

At the offices of the Angels, the team’s vice president of marketing and ticket sales listened to the roll of clubs that saw thousands of tickets sell for less than face on that night and sighed in resignation.

“We did it to ourselves,” said Robert Alvarado, who this season watched an average of 4,100 of his tickets sell on StubHub for each game. “StubHub was a small player. And we blew it up. They’re legitimate now. And it’s killing us.

It’s killing us.

“Location. Price. Just about every advantage we had over the

secondary market is gone. It’s the blurring of the lines. Because, in my opinion, we failed to do our due diligence before we jumped into bed with StubHub.”

Alvarado spun back to an industry meeting four years ago, when news circulated that MLB would sign a lucrative deal to integrate StubHub as its official reseller. The Angels, who were happy with the resale site they were running for their season-ticket holders, were vocal opponents of the deal.

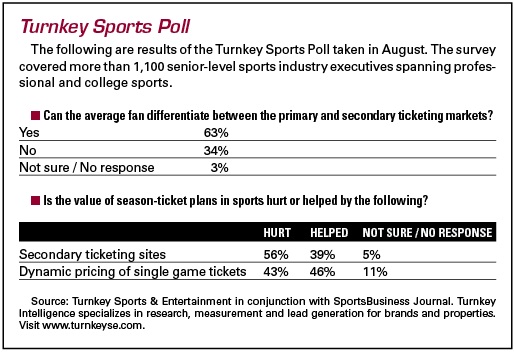

“I was one of two or so people that spoke up,” Alvarado said. “StubHub was going to throw this big check on us. We were going to capture names of buyers that we weren’t capturing before. And I remember, I said, ‘Mark my words: Heaven help us. Heaven help us because the customer isn’t going to know the difference between the primary and the secondary once we’re a few years into this thing.’

“I don’t see myself as a prophet, but it happened. We got screwed.”

Alvarado remains a harsh critic of the deal. But he concedes that it came to be for reasons that sounded attractive to many, and still resonate today.

“They paid baseball a fair amount of money; a lot of money,” said Bob DuPuy, who was president of MLB when the owners made the deal. “There was a realization that someone was going to serve as the secondary market for tickets. Better to get paid and have it be StubHub than to not get paid and have it be Hubstub.”

Whether it was resignation to the inevitable, or the recognition of an opportunity, MLB’s deal with StubHub has changed the world for many teams; none more so than those in baseball, with all its seats and games.

For StubHub, the baseball deal mirrors a marked upward tick for the company as a whole and the secondary ticket market at large. When StubHub signed the MLBAM deal in 2007, its website averaged 2.5 million unique visitors. Today, it’s more than 12 million. StubHub’s brand awareness stands at 65 percent, the second-largest such figure of any ticketing company, trailing only industry giant Ticketmaster.

“StubHub paid a lot of money to get that kind of Kleenex brand preference,” said Dave Butler, CEO of Paciolan, the No. 2 brand on the primary ticketing side. “Some may not like it, but they’ve won that war.”

The MLBAM alliance, of course, isn’t solely responsible for the lift. But StubHub has used the baseball deal as a template for an array of subsequent pacts with teams and leagues, particularly within college sports. For a company that started more than a decade ago as Liquid Seats and was openly derided by team and league executives as simply electronic ticket scalping, the shift has been striking.

“Not all these deals in the industry have worked out,” said Greg Bettinelli, a former eBay Tickets executive who was one of the principal architects of the StubHub-MLBAM deal. “But with baseball, everybody got paid, barriers were broken down, and the fan had a better experience.”

Now a senior vice president for Nordstrom-owned discount outlet HauteLook, Bettinelli said none of the principals involved could have fully foretold the downward ticket price pressure that would beset the deal, and secondary ticketing in general. Since 2007, average ticket sales prices on StubHub, regardless of sport, have fallen each year, dropping from $112 per ticket in 2007 to $104 in ’08, $94 in ’09, $84 in ’10 and $82 thus far this year.

While a tumble in discretionary spending is to blame for some of that, Schiller and others more often point to the flood of ticket postings as the root.

“By creating an ease of integration and credibility, we have allowed for a great deal of amateur resellers to get into that marketplace, and now we’ve got this tremendous volume of tickets showing up,” Schiller said. “The casual fans can see they can make money. And in a lot of ways they have become smarter than many of the teams themselves. They’re better at selling tickets. They don’t have the issues and handicaps the teams have. It’s something very problematic for the industry now that we made it credible.”

Here’s what often happens:

A ticket broker — either professional or semi-pro — buys season tickets. Or a fan plans to sell enough games to finance part, or all, of his cost. Both hold tickets to games they have no intention of attending.

Brokers might expect to make money on most Red Sox games, because they’re all sold out. But in most cases, they

figure they’ll turn large profits on a handful of marquee games and try to break even on the rest. With so many tickets on the market, it’s a race to get out first. In the days leading up to most games, prices fall steadily. In the case of Aug. 5 games, the average sale price fell from $73 on Monday to $65 on Wednesday and $50 on Friday.

“If a season-ticket holder or avid fan sees that they can get a ticket for less than full price, that becomes a problem,” said Adam Kanner, a former NBA executive who is CEO and co-founder of ScoreBig, a recently launched online reseller that would allow teams and concert promoters to unload discounted tickets blindly, a la Priceline. “This is why the secondary market is dangerous. If the secondary market were still focused on what it was built to do — sell stuff for more and provide season-ticket holders with a convenience — then there’s some uncaptured opportunity for the teams, but it still solves a real problem. Instead, it has become the problem.”

The root of that problem, teams and ticketing companies say, is that clubs traditionally haven’t priced tickets in a way that reflects demand.

That has been the drumbeat of Ticketmaster for the past year. This summer, Hubbard embarked on a road show in which the company met with about 1,000 clients in six weeks. The secondary market and its impact on pricing was only a small part of what they discussed. But, in Hubbard’s mind, nothing was more important.

“First of all, they have to price their tickets better,” Hubbard said, pointing to improvements some Ticketmaster clients saw when testing dynamic pricing last year. “In many cases, they’re underpricing the premium games and overpricing the non-premium games. You have to address that. And, oh by the way, set the season-ticket prices up front in a smarter way. The good news in this for the teams is that a lot of them are charging too little for their season tickets. If the broker is buying it, it’s not the right price.”

It’s not an issue for all teams, but it’s a key point for some. Among the 15 games played on Aug. 5, five showed sizable opportunities for sellers to use discounts they got purchasing season tickets to undercut the teams. To smoke those out, SportsBusiness Journal identified sales where the purchase price was below the single-game price offered by the teams, but high enough for the StubHub seller to turn a profit. Five teams saw it occur on more than one-fourth of their StubHub sales — the Orioles (25 percent), Angels (30 percent), Rockies (33 percent), Diamondbacks (42 percent) and Rangers (53 percent).

Looking at those clubs and those particular tickets, more closely, it’s clear that it happens because of wide gaps between their season-ticket prices and single-game prices. When a team offers a season-ticket incentive, such as the Angels’ “Buy 2 at Window Price, Get Two Free” program, or the Braves’ “Buy 3, Get 1” deal, it creates even more profit potential for resellers.

“The teams, including the Atlanta Braves, caused some of our issues,” Schiller said. “It doesn’t mean that we like it. But we were inadvertently the cause of certain increases in the secondary market, just by the way we sold our tickets and priced our tickets and distributed them.

“We have to look at all those things.”

The good news, Schiller said, is that some of the fixes might be relatively easy.

One that is catching on rapidly — first in the NBA and now in baseball — is variable pricing of season tickets. The season-ticket price remains the same, but the price shown for each game varies. Season-ticket holders might see a price of $32 on their seats for most weekend games, but $55 when the Yankees are in town and $18 for most weeknight games. That allows the team to price single-game seats to low-demand games as low as $18 without raising the ire of the season customer who previously would have thought of that as lower than what he paid.

Another emerging trend is the shift toward dynamic pricing, which adjusts ticket prices based on supply and demand as the season goes along. Only the Giants and Cardinals set all their prices that way last season, but many other teams tested the strategy in some sections. More will join that group this season. Some believe that if dynamic pricing gains acceptance, many of the pressures teams feel from the

secondary market will dissipate.

Interestingly, the ticket executive from the team that has won biggest with dynamic pricing thus far has his doubts about that. While dynamic pricing allows the Giants to move down on prices when seats don’t sell, they have promised season-ticket holders they would always get the lowest price.

“If anything scares me about dynamic, it’s that in a down time you have to push the envelope on floors,” Stanley said. “We’ve committed that we’d never go below the face value we set for that game at the start of the season. Well, there are times we may miss on that. Maybe we have the game [in the wrong price category].

“I’d like to get to a point where the season-ticket holder looks at the ticket as a whole package. We’d never go below what the package cost. If your ticket said $10 and I sell it for $8, you don’t care because if you bought your $800 ticket package one ticket at a time it would be $1,000. We have to get beyond the idea that there’s a value on each ticket and get fans to see it as a package.”

What’s next?

Lou DePaoli’s view of the secondary market changed almost a decade ago, when his wife’s younger brother saw his number come up on the Boston Red Sox waiting list. He bought season seats in the bleachers in right field, above the Sox bullpen, about 15 rows up. Then a single high school teacher who had recently finished work on his master’s degree, DePaoli’s brother-in-law went to about 60 of 81 games for each of the first few years.

“He’s a baseball fanatic, so he went to as many as he could,” said DePaoli, the Pittsburgh Pirates’ executive vice president and CMO. “And then it hit him. I don’t need to go to 60. What if I went to 40 and sold the rest? What if I only took 20? What if I sold the Yankees games? I’ll go watch the A’s on a Tuesday and my profits will pay for everything, plus cover 25 percent next year. I can go to all the baseball I want to, and make money, too.

“He teaches AP economics now. He uses his tickets as an example of supply and demand.”

DePaoli suspects he is an outlier on much of the current debate around StubHub. He doesn’t mind others making money on his tickets, so long as it keeps them coming back to buy more. While many teams profess a distaste for brokers, DePaoli embraces them, targeting them for season tickets and contacting them to offer a package when he sees them hitting high-demand games. He says he is drop-dead sure that he has made more sales as a result of leads generated via StubHub than he has lost when its listings beat his price.

“I know a lot of people think the sky is falling,” said DePaoli, whose club sees about 2,100 tickets move on StubHub per game. “I don’t see it that way. It’s something you have to be aware of and work within. It’s not going to be the end of season tickets. It’s not going to wipe out our single-game sales.

“How flexible are you to changing your business model? How do we appropriately price our tickets? That’s what this is.”

Derrick Hall, president and CEO of the Arizona Diamondbacks, takes a similar view.

“When you finally realize that the secondary market is actually an incentive to sell season tickets — which is what we’re all in the business of doing — then you embrace it and you use it,” Hall said “We don’t hit our numbers without StubHub. So as much as we could complain — and it’s a great excuse to take to the owner, because he knows the other owners are hearing it — you can’t have it both ways.”

Based on conversations with other team executives, many see it as more than that.

One point generating debate is the desire, shared by many teams, that the next iteration of MLB’s resale market include a floor on prices. They want to keep sellers from listing tickets below season prices on their official marketplace — StubHub, or whatever they choose next. Even one team that has benefited from high StubHub demand — the Twins — says it favors a floor.

Alvarado, of the Angels, says he would oppose any deal that didn’t include a floor.

“If StubHub doesn’t want to alter that model, we’ll have to look elsewhere,” Alvarado said. “I believe the majority of teams will put their foot down and say we’re not going to do this without a hard floor.”

The president of StubHub, Chris Tsakalakis, acknowledges the company has heard those concerns from some teams, but said there is no interest from his camp in any sort of price floors or other pricing controls.

“If we were to impose price controls, floors or ceilings, that would just open things up to a competitor who would not,” Tsakalakis said. “Market pricing by its very nature is free, and trying to control it just means you push it to other avenues.”

StubHub, for its part, would like to renew the MLBAM deal.

“Baseball has been a very good partner, and we are very keen to continue the relationship if that’s what ends up happening,” Tsakalakis said. “We’d definitely like to remain in partnership with them.”

It could well go that way. Or MLBAM could launch its own branded secondary market. It could allow teams to choose their own official resellers, as they do in the primary market, and marry the two. Bowman said one thing that is clear is that clubs likely would be best served in this next go around if each has more latitude to choose what’s right for them.

“We have to manage this issue,” said the Braves’ Schiller. “Doing the SWAT analysis, this is threat No. 1. But it also is an opportunity. Because if we become smarter in the way we manage this part of the business, it can lead to increased revenue and ticket sales.

“And if we don’t, we’re going to head the other way.”

Mariners @ Angels Attendance: 38,727

654 sales 2,074 tickets

$53,794 in sales

Sold below face: 91%

See details

Weather: 70 degrees and clear

Story line: Angels at 61-51, trailing first-place Rangers by one game.

- 654 transactions involving 2,074 tickets sold for $53,794, including StubHub fees, in the span from Monday through Friday, four hours before game time.

- Value to the Angels and their ticket vendor, based on single-game prices, would have been $84,528.

- 1,894 of 2,074 tickets (91 percent) sold for less than face value.

- The discount of 36 percent off online box office prices was the largest on any game that day, a striking number for a club that was only a game out of first place.

- In 626 out of 654 sales (96 percent), buyers got a better deal on StubHub than they would have from the team, taking fees into account.

- StubHub buyers saved $30,744, including savings on fees.

- 39 percent of tickets sold for less than face, but more than the season-ticket price.

- Even after paying a 15 percent StubHub commission, sellers turned a profit while selling for less than face in 199 transactions (30 percent).

- The Angels offered additional price incentives to fans who bought at least four season tickets in some sections, giving them two seats free if they bought two at the ticket window price. Assuming that all the StubHub sellers with seats in those sections took advantage of that deal, they could have sold their tickets for less than face and still turned a profit on 159 out of 308 transactions (52 percent).

Braves @ MetsAttendance: 30,607

675 sales 1,927 tickets

$119,767 in sales

Sold below face: 76%

See details Weather: 79 degrees, partly cloudy

Story line: Fiesta Latina Night. Mets at 55-55 after losing four in a row; eight games behind Atlanta in the wild card race.

- 675 transactions involving 1,927 tickets sold for $119,767, including StubHub fees.

- Value to the Mets and their ticket vendor, based on single-game prices and fees, would have been $153,035.

- 1,575 tickets (76 percent) sold for below face value.

- In 588 out of 675 sales (87 percent), buyers got a better deal on StubHub than they would have from the team, taking fees into account.

- StubHub buyers saved $33,268, including savings on fees.

- In no case did the seller turn a profit while selling under face.

- 12 percent of tickets (230 of 1,927) sold for less than face but more than the season-ticket price. The Mets’ published discount on season tickets is 10 percent off the single game price, regardless of section.

Brewers @ AstrosAttendance: 25,811

115 sales 358 tickets

$11,835 in sales

Sold below face: 84%

See details

Weather: Indoors

Story line: Astros, with the worst record in baseball (37-74), entertain the first-place Brewers.

- 115 transactions involving 358 tickets sold for $11,835, including StubHub fees, making it the second-least trafficked game of the day.

- Value to the Astros and their ticket vendor, based on single-game prices and fees, would have been $16,505.

- 300 tickets (84 percent) sold for less than face.

- In 101 out of 115 transactions, buyers got a better deal on StubHub than they could have from the team, taking fees into account.

- StubHub buyers saved $4,671, including savings from fees.

- Only 11 of 115 sellers turned a profit after paying commissions.

- Only one seller turned a profit while selling below face.

- Even for a bad team, beachfront property retained some value. Of the 56 tickets that sold for more than face, 17 were in the front row of a section.

- The Astros tested variable pricing in one seating category: Field box. That price dropped as low as $36, or $1 less than the season price. Still, StubHub’s prices were lower than the box office on 77 of 102 tickets it sold in that category.

Blue Jays @ OriolesAttendance: 18,770

209 sales 616 tickets

$22,398 in sales

Sold below face: 77%

See details Weather: 86 degrees, partly cloudy

Story line: Orioles enter with the worst record in the American League (43-65).

- 209 transactions involving 616 tickets sold for $22,398, including StubHub fees.

- Value to the Orioles and their ticket vendor, based on single-game prices and fees, would have been $28,459.

- 477 tickets (77 percent) sold for less than face value.

- In 176 out of 209 sales (84 percent), the buyers got a better deal on StubHub than they could from the team, taking fees into account.

- StubHub buyers saved $6,061, including savings from fees.

- Sellers turned a profit while beating the team on price 53 times (25 percent), even after paying a 15 percent StubHub commission.

- 53 percent of tickets sold were priced below face, but higher than the season-ticket price. Only the Rangers and Diamondbacks saw that happen more frequently than the Orioles.

Yankees @ Red SoxAttendance: 38,006

537 sales 1,248 tickets

$304,761 in sales

Sold below face: 0.5%

See details

Weather: 73 degrees, partly cloudy

Story line: Long before anyone could have anticipated their epic collapse, the Sox play host to the Evil Empire, with the two teams tied for first.

- One of the greatest rivalries in sports delivered the day’s most lucrative StubHub venue, although far from its busiest. The five days leading up to the game produced 537 sales involving 1,248 tickets for $304,761, including StubHub fees.

- Sellers collected a markup of more than three times the $92,528 those tickets would have cost, fees included, if bought at single-game prices on MLB.com.

- The profit for sellers, after paying StubHub commissions: $154,559. That’s an average of $289 per profitable transaction (Two sales registered small losses. See below.).

- Supply and demand laws were in full effect. While no game generated as much money for sellers, seven of the other 14 games played on this night saw more tickets change hands.

- A few of the gaudier sales: $1,497 each for four seats piggy-backed in the first two rows of the dugout boxes; $1,143 each for four seats in Row J in the field boxes; $1,000 each for a pair in Row C in the field boxes.

- Bleacher seats, sold at the box office for $12 and $28, went for an average of $144 each. Sellers moved 252 of them in five days.

- It was only slightly cheaper to stand than it was to sit knee to knee in the bleachers. Buyers snapped up 59 standing room only slots at an average of $135 each. They retailed for $20 to $35, depending on the location.

- There is a Santa Claus. The day before the game, someone sold six tickets near the back of the right-field boxes for $50 each — $3 more than season-ticket holders paid, but $2 below face, making them the only tickets to sell for less than face all week. The average price paid for the other 211 tickets sold in the right-field boxes: $197.

Reds @ CubsAttendance: 42,245

561 sales 1,499 tickets

$115,158 in sales

Sold below face: 27%

See details

Weather: 78 degrees and cloudy

Story line: Cubs at 47-65, 15 games out.

- 561 transactions involving 1,499 tickets sold for $115,158, including StubHub fees.

- 73 percent of tickets sold for more than face value. Sellers registered a markup of 17 percent, or $10.41 per ticket.

- Despite that average markup, sellers lost money on 352 out of 561 transactions (63 percent) after taking into account commissions paid to StubHub. The bottom line gain across the 561 transactions, after commissions, was only $641, or barely more than $1 per ticket. Cubs season-ticket holders pay the same price as single-game buyers, so they only make money when selling for above face.

- Taking fees into consideration, buyers got a better deal on StubHub 184 times.

- Though sellers of Wrigley’s $330 dugout seats took a bath, most holders of prime property fared well. Forty-eight of 53 sales of $100 infield club seats went for higher than face. All but 11 of 246 infield Terrace Reserve seats went for more than their $42 box office price.

- Chicagoans are familiar enough with their bleacher seats to know exactly what they’re worth. Sellers moved 213 of them for an average of $58.12, or only 12 cents more than their face price.

Dodgers @ DiamondbacksAttendance: 27,215

252 sales 683 tickets

$23,712 in sales

Sold below face: 69%

See details Weather: Indoors

Story line: Diamondbacks 61-50, trailing the first-place Giants by a half game.

- 252 transactions involving 683 tickets sold for $23,712, including StubHub fees.

- Value to the Diamondbacks and their ticket vendor, based on single-game prices and fees, would have been $29,025.

- 470 tickets (69 percent) sold for less than face value.

- StubHub buyers saved $5,313, including savings on fees.

- In 83 percent of the sales, buyers got a better deal on StubHub than they could have from the team, taking fees into account.

- 350 tickets (51.2 percent) sold for less than face but more than the season ticket price.

- Sellers turned a profit while pricing tickets for less than face on 108 transactions (42 percent), even while paying a commission. Only the Rangers saw sellers undercut their prices and still make money more often (54 percent).

Phillies @ GiantsAttendance: 42,165

1,419 sales 3,862 tickets

$280,521 in sales

Sold below face: NA

See details

Weather: 61 degrees, clear

Story line: Two first-place teams in a rematch of the 2010 National League Championship Series.

- The busiest resale game of the night by volume, with 1,419 transactions involving 3,862 tickets that sold for $280,521, including StubHub fees.

- Based on typical fees and commissions (10 percent paid by the buyer; 15 percent paid by the seller), StubHub and MLBAM would have split $82,160 in revenue from resales in the five days leading up to the game. Because more active StubHub sellers pay lower commissions, the take likely was slightly lower than that for those five days.

- The resale of Giants tickets doesn’t fit the model applied to the other 14 games studied because the Giants were one of two clubs in MLB that used dynamic pricing for all their tickets this season (the Cardinals were the other). Because of that, it’s difficult to peg a single-game price. To get an idea of how the primary and secondary markets worked for the Giants, we chose prices the team charged on Wednesday morning of that week as the single-game price. Those could have moved in the days before or after we locked in.

- With that single-game price as the basis, fans actually would have spent more buying their tickets from the Giants at that Wednesday price — $321,214 — than they did buying them on StubHub. Sixty-five percent of tickets sold for less than that Wednesday Giants price. While interesting, the comparison isn’t particularly meaningful, since the Giants had few, if any, tickets available at the prices they were posting on their website.

- A far more relevant number: Tickets resold at a markup of 90 percent over season-ticket prices, based on variable, season face prices. The Giants use variable pricing on their season tickets, dividing games into four price categories. This game was listed in the second-highest category.

- Again, keeping in mind that the Giants had few tickets available, the single-game prices they listed probably made many of the StubHub tickets look like bargains. On 67 percent of sales, the seller was able to turn a profit at a price that was lower than what the team listed on that Wednesday. Sixty-five percent of all tickets sold for between the season-ticket price and the Giants’ Wednesday price.

Cardinals @ MarlinsAttendance: 19,303

97 sales 343 tickets

$10,531 in sales

Sold below face: 93%

See details Weather: 89 degrees, partly cloudy

Story line: Marlins at 55-56, 8 1/2 games out of the wild card.

- The slowest resale game of the night, with only 97 transactions involving 343 tickets, which sold for $10,531, including StubHub fees.

- Based on single-game prices and fees, the value to the Marlins and their ticket vendor would have been $15,590.

- All but five of 97 buyers paid less on StubHub than they would have if they bought from the Marlins.

- 94 percent of tickets sold for less than the single-game face price.

- 21 sellers (22 percent) turned profits while selling for less than the Marlins, even after paying StubHub a commission.

- 35 percent of tickets sold for less than the single-game face price, but more than the season-ticket price.

Padres @ PiratesAttendance: 37,766

575 sales 2,016 tickets

$56,996 in sales

Sold below face: 14%

See details

Weather: 90 degrees, partly cloudy

Story line: The bloom is off the rose for the Pirates, who have lost seven in a row to fall to 54-56, seven games back.

- 575 transactions involving 2,016 tickets, sold for $56,996

- Value of the tickets, based on Pirates single-game prices and fees: $43,246.

- 86 percent of tickets sold for more than face value. Sellers collected an average markup of 50 percent, or $8.88 per ticket.

- Sellers turned a profit on 90 percent of sales after taking into account commissions paid to StubHub.

- Taking the Pirates’ usual fee structure into account, buyers would have gotten a better deal on StubHub 159 times (28 percent). But because the Pirates waived fees for the week as a sales promotion, there’s no way to know for sure.

- On 60 transactions involving 227 tickets, buyers paid more than the season-ticket prices, but less than face.

- Even after paying a StubHub commission, 107 sellers were able to turn a profit while selling for less than face (19 percent). Those sales were clustered in a few areas. None came on tickets the team priced at more than $20. Forty-one of 86 infield grandstand sales — $16 seats that sold for $9.86 per game as season tickets — were profitable while below face. Sixty-one of 145 outfield grandstand seats, which were discounted by about half for season-ticket holders, generated profits while below face.

A’s @ RaysAttendance: 15,168

195 sales 491 tickets

$19,799 in sales

Sold below face: 91%

See details

Weather: Indoors

Story line: Still stumbling before making a run to the postseason, the Rays are 58-52 and 10 games out of both first-place and the wild card.

- 195 sales involving 491 tickets sold for $19,799, including StubHub fees.

- Value to the Rays and their ticket vendor would have been $27,065, based on single-game prices and fees.

- 184 out of 195 buyers (94 percent) paid less on StubHub than it would have cost to buy the same seats from the Rays.

- 91 percent of tickets sold for below face value.

- Only six of the 20 sellers who were able to turn profits after paying StubHub commissions were able to do so while undercutting the Rays on price.

- The Rays priced this as a Platinum game — their second highest of four categories — after adding a postgame concert by the B-52s. They also threw in a women’s T-shirt giveaway.

- 19 percent of tickets sold for more than the season-ticket price but less than face value.

Indians @ RangersAttendance: 37,842

650 sales 1,932 tickets

$80,079 in sales

Sold below face: 73%

See details

Weather: 105 degrees, clear

Story line: Indians only a game over .500 at 55-54, but still in second place in the Central, only three games out. Rangers leading the West, which they would win.

- 650 transactions involving 1,932 tickets sold for $80,079, including StubHub fees.

- Value to the Rangers and their ticket vendor, based on single-game prices and fees, would have been $92,075.

- 73 percent of the tickets sold for less than face value.

- 81 percent of buyers got a better deal on StubHub than they would have from the team, taking fees into consideration.

- Sellers were able to turn a profit while beating the team on price 350 times (54 percent), even after taking into account commissions paid to StubHub. Those deals accounted for 1,420 tickets (75 percent). That was the highest save/profit rate from any of the 15 games that day.

- StubHub buyers saved $11,996, including savings on fees.

- Sellers turned a profit on 472 transactions (72 percent), making an average of $30.45 per sale, or $9.54 per ticket, all after paying commissions. Assuming those tickets were purchased at season-ticket prices, sellers collected an average profit of 36 percent.

Nationals @ RockiesAttendance: 35,034

345 sales 1,165 tickets

$29,801 in sales

Sold below face: 78%

See details Weather: 86 degrees, partly cloudy

Story line: Rockies at 52-60, in third place and 10 games out of first.

- 345 transactions involving 1,165 tickets sold for $29,801, including StubHub fees.

- Value to the Rockies and their ticket vendor, assuming single-game prices and fees, would have been $39,894.

- 78 percent of tickets (910) sold for less than face value.

- On average, buyers paid 25 percent less from StubHub than they would have paid buying from the team. Seventy-eight percent of buyers got a better deal on StubHub than they would have from the Rockies.

- Assuming tickets were purchased at season prices, 186 out of 345 sellers turned a profit, averaging a profit of $20 per sale.

- Sellers were able to turn a profit while undercutting the team on price on one-third of all transactions (115).

- 44 percent of tickets sold for below face value but more than the season-ticket price.

Tigers @ RoyalsAttendance: 28,565

255 sales 895 tickets

$20,385 in sales

Sold below face: 92%

See details Weather: 89 degrees, partly cloudy

Story line: Last-place Royals, at 48-63, meet the first-place Tigers.

- 255 transactions involving 895 tickets sold for $20,385, including StubHub fees.

- Value to the Royals and their ticket vendor, assuming single-game prices and fees, would have been $29,330.

- 92 percent of tickets sold for less than face value.

- Assuming sellers paid season ticket prices, only 12 were able to turn a profit on their tickets while undercutting the team on price.

- It wasn’t a good night for many sellers: 66 percent of tickets sold for less than the season ticket price.

- StubHub buyers saved $8,945, including savings on fees.

White Sox @ TwinsAttendance: 41,364

845 sales 2,357 tickets

$151,898 in sales

Sold below face: 7%

See details

Weather: 82 degrees, partly cloudy

Story line: Twins, a disappointing 51-60 and eight games out, face a division rival that’s also struggling.

- n 845 transactions involving 2,357 tickets sold for $151,898, including StubHub fees.

- Value of the tickets based on Twins single-game prices and fees: $102,314.

- The chance to watch baseball outdoors in the summer in Minnesota retained its value, even in the face of a brutal season. Ninety-three percent of tickets sold for more than face value. Sellers collected an average markup of 56 percent over single-game prices. The average markup over season-ticket prices was 84.7 percent.

- Discounting was rare, but there was some. Nine percent of buyers (83) got a better deal on StubHub than they would have from the team when considering fees paid on both sites.

- 47 of the 83 sellers who beat the team on price still were able to turn a profit, assuming they paid season-ticket prices.

About our ticketing projectThe idea for this project was born shortly after I became a first-time StubHub customer in April. I bought four tickets to a Saturday night baseball game at prices below the team’s. When they arrived, I saw that, based on the price printed on the ticket, the seller — who was a broker — had turned a small profit. While I celebrated my savings, I knew this couldn’t be good for the team. I wondered how often it happened. We decided to take a look.

|

| King |

Registering as sellers, five members of the SBJ staff logged StubHub sales beginning on the Monday before the games of Friday, Aug. 5, a date that typically sells well for MLB teams and, this season, included several high-profile matchups. With that raw data in hand, we began compiling other numbers that enabled us to make comparisons — single-game prices and fees, and season-ticket prices. For the teams that use variable pricing, we adjusted the season price to reflect the level of game.

From there, baseball writer Eric Fisher and I used the data as the premise for some questions. Teams told us that while what we had was merely a snapshot, it reflected some of the key issues that they face. So we started asking more questions. What we heard back framed the story in this issue.

You’ll find far more data — including an analysis of each of the 15 games — on our website, sportsbusinessjournal.com. Click on a game and you’ll find the numbers behind the numbers, including how much fans saved by buying on StubHub and how much sellers likely made or lost while flipping their tickets. You’ll also find a few surprises, such as the fact that on the day before the Boston Red Sox game against the New York Yankees at Fenway, someone sold six tickets near the back of the right-field boxes for $50 each, which was $2 under face and $147 below the average price for the other 211 tickets sold in that section. Apparently, even Santa sells on StubHub.